The Rise of Rental Payment Plans and What Housing Providers Need to Know

Past Due Rent Payment Plan Agreement Template

- FrontLobby

- Published

- Updated: May 17, 2024

Table of Contents

The Evolving 2024 Housing Market

The Crucial Role of Rent Payment Plans

Navigating Financial Challenges with Past Due Rent Payment Plan Agreements

Payment Plan Agreement for Rent: Building Sustainable Relationships

The Flexibility and Adaptability of Payment Plans for Rent

Past Due Rent Payment Plan Agreement Template

Case Study: Rent Payment Plan Using FrontLobby’s Rent Reporting Platform

Rent Payment Plans as a Response to Economic Trends

Embrassing Change for Future Success

The Evolving 2024 Housing Market

In the dynamic world of 2024’s housing market, one trend stands out: the growing importance of rent payment plans. Amidst economic uncertainties and a changing demographic landscape, these plans are becoming pivotal in balancing the needs of Tenants and Landlords. They’re not just a trend but a strategic necessity in a real estate market characterized by tight supply and fluctuating demand.

The Crucial Role of Rent Payment Plans

With the ongoing mismatch between housing supply and demand, rent payment plans are emerging as a key solution. They address the financial challenges Tenants face due to high living costs while ensuring Landlords maintain a steady income stream. As rents don’t show signs of decreasing, and operational costs for Landlords rise, these plans offer a flexible approach to rent collection. They’re transforming how rent is viewed – not as a rigid, one-time monthly payment, but as a more adaptable financial obligation.

Navigating Financial Challenges with Past Due Rent Payment Plan Agreements

Life’s unpredictability can lead to Tenants falling behind on rent. Here, the past due rent payment plan agreement serves as a critical tool. It offers a structured method for Tenants to catch up on overdue rents, reducing the need for evictions and maintaining Landlord-Tenant relationships. This approach not only aids Tenants in managing their finances during tough times but also helps Landlords in securing their income, albeit in a staggered manner.

Payment Plan Agreement for Rent: Building Sustainable Relationships

A well-crafted payment plan agreement for rent can be the foundation of a long-lasting, mutually beneficial Landlord-Tenant relationship. These agreements, when agreed upon by both parties, can lead to improved Tenant loyalty and reduced turnover rates. They provide a clear structure for rent payments, making financial planning easier for Tenants and income forecasting more accurate for Landlords. In a market where Tenant satisfaction is as crucial as financial returns, these agreements stand as a testament to a Landlord’s commitment to their Tenants’ well-being.

The Flexibility and Adaptability of Payment Plans for Rent

The payment plan for rent is not a one-size-fits-all solution; it’s a flexible tool that adapts to varied financial situations. In a market where some Tenants may be grappling with job changes, salary fluctuations, or other economic pressures, these plans can be tailored to individual needs. For Landlords, offering this flexibility can mean the difference between retaining a reliable Tenant and facing the costs and uncertainties of finding a new one. It’s an approach that values empathy and understanding, crucial in today’s market.

Past Due Rent Payment Plan Agreement Template

Creating an effective rent payment plan agreement template involves outlining specific terms that provide clarity and fairness for both the Landlord and Tenant. Here are some key components that should be included in such an agreement:

Identification of Parties: Clearly state the names and contact information of the Landlord and Tenant(s).

Original Rental Agreement Reference: The payment plan should be linked to the original rental lease or agreement, specifying its date and any relevant details.

Reason for the Payment Plan: Briefly outline the circumstances that have led to the need for a payment plan, such as financial hardship.

Details of the Outstanding Rent: Specify the total amount of rent that is past due, along with the period for which this rent is owed.

Payment Schedule: Outline a detailed schedule for repayments. This includes the number of installments, the amount of each installment, and the due dates for these payments.

Method of Payment: Indicate how the Tenant should make payments, whether through checks, bank transfers, or other methods.

Late Payment Consequences: Describe any consequences or penalties for late payments under the plan.

No Interest Clause: Often, these agreements do not include interest rates on the delayed rent, but this should be explicitly stated.

End Date of the Payment Plan: State the date by which all deferred payments are expected to be completed.

Signatures: Ensure that both the Landlord and the Tenant sign the document, validating the agreement.

Legal Considerations: Include any legal considerations or clauses, such as the agreement not waiving the Landlord’s right to pursue future legal action if the Tenant fails to meet the terms of the payment plan.

Amendment to the Original Lease: Clarify that the payment plan is an amendment to the original lease and does not constitute a new lease agreement.

Acknowledgment of No Other Changes: Affirm that all other terms of the original lease remain unchanged and in full effect, except for the modifications made by the payment plan.

Voluntary Agreement: Highlight that the agreement is entered into voluntarily by both parties.

This past due rent payment plan agreement template should be customized based on the specific situation and needs of the Landlord and Tenant. It’s essential to ensure that the agreement is fair, clear, and legally binding to prevent future disputes or misunderstandings.

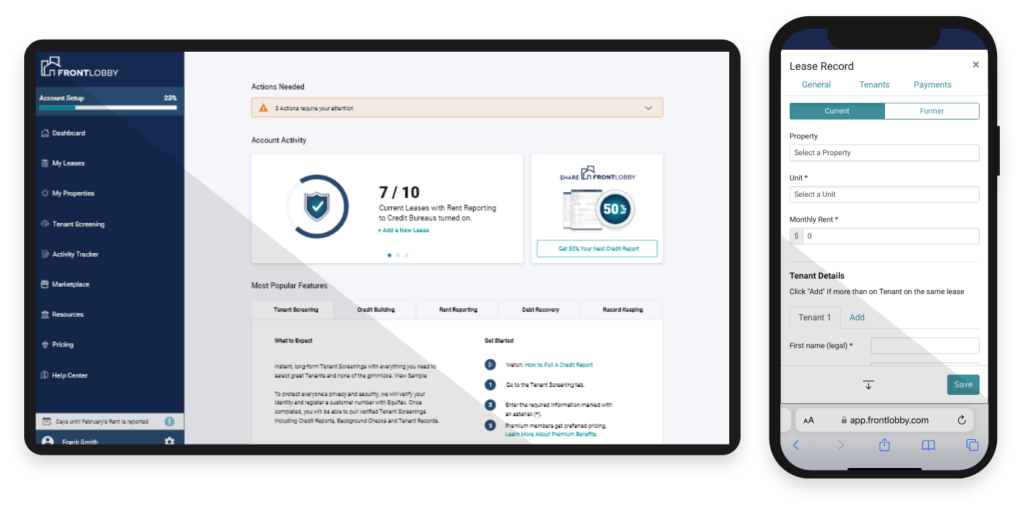

Case Study: Rent Payment Plan Using FrontLobby’s Rent Reporting Platform

Background:

In the ever-evolving rental market, maintaining a healthy credit score can be a challenge for many Tenants, especially those who experience financial hiccups. FrontLobby recognized this issue and developed a solution that not only assists Tenants in maintaining their credit scores but also supports them when they fall behind on rent.

With FrontLobby’s Rent Reporting platform, both landlords and tenants can agree to a payment plan while also contributing positively to the tenant’s credit score. This arrangement creates a win-win situation where tenants can build their credit history and improve their financial profiles, while landlords can enjoy increased financial stability and a more reliable income stream.

Challenge:

John, a Tenant in a mid-sized city, faced unexpected medical expenses that affected his ability to pay rent on time. His Landlord, Sarah, was concerned about the potential loss of income and the hassle of finding a new tenant if John defaulted on his rent.

Solution:

Sarah, aware of FrontLobby’s innovative services, proposed a payment plan for rent (link to Help Center question about payment plans) to John. This rental payment plan agreement, facilitated through FrontLobby, allowed John to pay his overdue rent in manageable installments. The terms of the agreement were clearly defined and agreed upon by both parties. Importantly, as long as John adhered to the terms of the rental payment plan, his payments were reported to credit bureaus. This setup meant that John could maintain and potentially even build his credit while he caught up on rent.

Outcome:

John successfully met the payment plan terms, gradually paying off his overdue rent without incurring additional financial stress. His credit score remained stable and even showed improvement due to the consistent payment history reported through FrontLobby. Sarah benefited from a steady stream of income and avoided the costs associated with Tenant turnover. The payment plan and subsequent reporting to the Credit Bureaus created a positive outcome for both Tenant and Landlord, fostering a stronger, trust-based relationship.

Conclusion:

This case study exemplifies how FrontLobby’s rent payment plans can be a win-win for both Tenants and Landlords. Tenants like John get a chance to manage their finances without damaging their credit scores, while Landlords like Sarah maintain a stable income and Tenant relationship. FrontLobby’s approach reflects a deeper understanding of the challenges in the rental market, providing solutions that support financial stability and trust between both parties.

Rent Payment Plans as a Response to Economic Trends

The implementation of rent payment plans is also a response to broader economic trends. With uncertainties in the job market, fluctuations in wages, and the general cost of living on the rise, these plans offer a buffer against economic shocks for both Tenants and Landlords. They provide a sense of security in an otherwise unpredictable economic landscape, ensuring that rental agreements can withstand financial turbulence.

Embracing Change for Future Success

The rise of rent payment plans in 2024 is more than a fleeting trend; it’s a shift in the paradigm of rental agreements. For forward-thinking Housing Providers and Landlords, embracing these plans is a step towards future-proofing their business. It’s about acknowledging the changing realities of the market and adapting to meet the evolving needs of Tenants. In doing so, they’re not just securing their financial future but also fostering a more resilient and responsive housing market

Did You Enjoy This Article?

Then You Will Love Our Newsletter