Report Rent Payments

To Help Build Credit

- Add Rent Payments to Your Credit Report

- Build a Positive Tenant Record with Housing Providers

- Create or Verify your Lease Record

- Monitor Your Records

- Unlock Credit Related Rewards

Earn the Credit You Deserve and Enjoy the Rental of Your Dreams

Add Rent To Your Credit Report And Tenant Record

Sign up for free, create your Lease Record, invite your Housing Provider.

Continue to pay rent on time

to build Credit and Tenant Record.

Access more credit products and secure the rental housing your want.

Add Rent To Your Credit Report And Tenant Record

Sign up for free, create a Lease Record, invite your Housing Provider.

Continue to pay rent on time

to build Credit and Tenant Record.

Access more credit products and secure the rental housing you want.

Proudly Featured In

Build Credit For Paying

Rent Each Month

Start reporting your rent payments. Good credit can help you obtain lower rates which can save you money in the future.

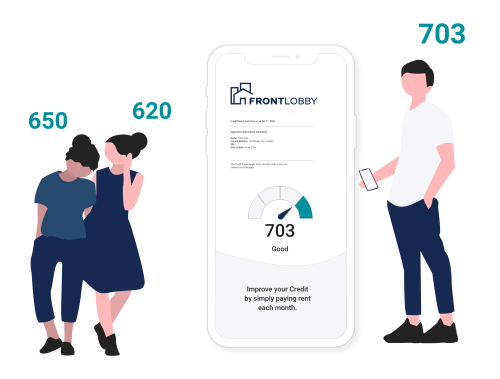

Build Credit With Your Rent

Tenants who pay their rent on time every month should receive credit for it, but most do not. Historically, rent has not been included on Credit Reports. We want to change this by elevating rent payments to the same level as consumer loans and credit card payments. Rent Reporting adds a new tradeline to your credit file while demonstrating a positive payment history over time, both are factors that help to boost your credit score.

If your rent payments are part of your Credit Report, lenders may view it in the same way they view a mortgage payment, giving you access to the credit you deserve.

Create A Positive Tenant Record

Being a good tenant – meaning, paying rent on time and taking care of the property – doesn’t usually come with incentives. But some Housing Providers offer rewards, like Rent Reporting and verified Tenant Records. By utilizing these services, Renters can build their credit and qualify for higher-level rentals of their choosing.

A positive Tenant Record will show your future Housing Provider that you’re reliable and capable of fulfilling the terms of a lease, allowing you to stand out above the other applicants. This is especially important if you have little or no credit history—for example if you are a young student or newcomer.

Monitor Your Records

Accurate records are an essential part of your financial health and your ability to secure the rental you want in the future. It’s important to keep track of your on-time rent payments and to always communicate with your Housing Provider about any discrepancies or problems that arise. This will ensure that you are seen as a reliable Tenant and safeguard your credit. Our free and user-friendly tracking system is the perfect way for you to keep track of your rent payments every month.

Unlock Rewards

Poor Credit, thin credit or no credit can be very expensive, most lenders do not want to take the risk and will charge high interest rates as a result.

By taking the steps to improve your credit, you can save money and put yourself in a better financial position. In fact, an improved credit score may lower how much interest you pay for credit cards, loans and other financing. It can also open doors to new opportunities, such as securing a lease or being approved for a loan.

Valued by Housing Providers, Loved by Renters

June 8th, 2025

May 20th, 2025

April 11th, 2025

April 3rd, 2025

February 16th, 2025

January 5th, 2025

January 15th, 2025

December 11th, 2024

December 15th, 2024

November 15th, 2024

September 22nd, 2024

June 10th, 2024

July 28th, 2024

March 20th, 2024

March 20th, 2024

March 20th, 2024

March 7th, 2023

April 28th, 2023

February 1st, 2023

June 4th, 2023

June 8th, 2023

June 19th, 2023

May 15th, 2023

January 31st, 2023

December 7th, 2022

October 29th, 2022

June 6th, 2022

April 20th, 2022

December 21st, 2022

August 20th, 2022

September 22nd, 2022

September 9th, 2022

January 31st, 2022

November 20th, 2021

May 25th, 2021

May 23rd, 2021

June 2nd, 2021

November 19th, 2021

March 6th, 2021

May 11th, 2021

March 2nd, 2020

June 2nd, 2020

+ We are committed to earning 6 out of 5 stars from our members.

Common Questions

Rent payments do not need to be made through the FrontLobby platform for Rent Reporting to Credit Bureaus to work. We know being a Renter requires flexibility, this means being able to make rent payments in whichever way works best for you and your Housing Provider.

FrontLobby has assisted thousands of renters in reporting their rent payments to Credit Bureaus, creating a credit history , and helping to establish a verified Tenant Record.

With our Rent Reporting tool Tenants have reported credit score jumps of 36pts to 84pts in the first 6 months. Jumps like this can have a meaningful impact on your financial future, and may help you access five major things.

Lower Interest Rates: With lower interest rates on mortgages, car loans, and personal loans, your monthly payments decrease, freeing up more of your budget for savings and expenditures.

Favourable Credit Terms: Increased approval odds for credit enable you to make informed financial decisions for your future, whether you’re pursuing further education, home improvements, or a new vehicle.

Expanded Credit Limits: You could become eligible for higher credit limits automatically, granting you greater financial flexibility during emergencies and making it easier to maintain a reasonable credit utilization rate.

Premium Financial Products: Your chances of qualifying for premium credit cards, such as rewards and cashback cards, as well as other top-tier financial products, can significantly improve.

Rental Applications: Housing Providers frequently request a copy of your credit report as part of the rental application process. A strong credit history can signal are a dependable Tenant.

Bonus: Having a verified Tenant Record can help you skip the line when applying for your next rental.

Ready to sign up? Tenants can get started for free here.

For Renters, good credit builds over time and can require a mixture of credit accounts. With FrontLobby, rent payments are reported as a trade line on a Tenant’s Credit Report, one of the proven ways to help build a strong credit report. Read more about the benefits in Equifax’s Rental Tradeline Study

Housing Providers often find themselves faced with multiple applicants for highly desired properties. In such cases, the deciding factor often comes down to something concrete and quantifiable like credit history. Unfortunately, renting to someone with little or no credit history can pose known and unknown risks and challenges for Housing Providers.

This means many Renters find themselves in a tough spot, especially those who are new to credit or new to the country.

Fortunately, a verified Tenant Record allows Renters to demonstrate a positive track record of paying rent even if they have a poor credit score. When Landlords, Property Managers and Tenants report rent payments to Landlord Credit Bureau, Tenants can build a positive Tenant Record, allowing future Housing Providers to evaluate prospective Tenants on more than just credit scores.

With FrontLobby rent payments can be shared with Equifax and Landlord Credit Bureau to be reflected on a Tenant’s Credit Report and Tenant Record.

Survey’s show that over 50% of Renters want to improve their credit. FrontLobby is a great way for Tenants to report their rent payments to Credit Bureaus, like Equifax and Landlord Credit Bureau.

You may have received an invite from your Landlord or Property Manager. If this is the case, please use the link in the email invitation to sign up. It is free and only takes a few minutes. Once your account is complete you can log in to view and verify your Tenant Record.

If you find any inaccuracies on your Landlord’s internal records or other information submitted to the Credit Bureaus through FrontLobby, please complete our dispute form and submit it to support@frontlobby.com.

The dispute form with instructions can be found here.

Alternatively, if you have concerns regarding details on your Credit Report that are not related to rental data or believe you have been the victim of Identity Theft or Fraud, please reach out to the appropriate Credit Bureau directly.

For individuals in the US, you can read more about your rights under the FCRA here.

Additional details from the Consumer Finance Protection Bureau can be found here.

FrontLobby aims to facilitate proactive and positive conversations between Housing Providers and Renters. When applicable, we encourage all parties to work towards a mutually agreeable payment plan.

If a payment plan is in place and a Tenant is paying according to the plan, no debts may be reported to the Credit Bureaus. Payments according to the payment plan should be recorded as being paid on time and the Tenant may use them to build their credit. However, if a Tenant stops paying according to the payment plan, the total outstanding debt may be recorded.

If a Tenant believes a debt is being reported when there is a payment plan in place, please follow our dispute process outlined here.

Every time we receive a great question, we add it to our Help Center. Using this great resource, you’ll find the answer to almost every question.

Helping Housing Providers and Renters Prosper

Join our mission to improve the rental industry for everyone.