FrontLobby vs. OpenRoom vs. Chexy vs. Borrowell

Comparing Canada's Rent Reporting Services

- FrontLobby

- Published

Table of Contents

What is Rent Reporting and How Does it Work?

Founding Story of Rent Reporting

Comparing the Features and Benefits

FrontLobby: Canada’s Founder of Rent Reporting

Borrowell: Tenant Self-Managed Reporting

Chexy: Rewards for Tenants

OpenRoom: Crowdsourced Judgements

Which Rent Reporting Provider is Right for You?

As the saying goes, an ounce of prevention is worth a pound of cure. Rent Reporting is quickly becoming an essential tool, offering Landlords and Tenants the ability to include rental payment history in credit reports and scores. There is a reason almost every industry reports to Credit Bureaus – because it is effective.

Whether you’re looking to recover unpaid rent, encourage on-time payments, or help renters build credit, choosing the right provider is crucial. This article reviews four of the Rent Reporting services in Canada – FrontLobby, OpenRoom, Chexy, and Borrowell – with each offering different capabilities and focus. This comparison examines each platform based on critical factors such as capabilities, coverage, automation, and legal compliance.

What is Rent Reporting and How Does it Work?

Definition of Rent Reporting

Rent Reporting is the process of reporting rental payment history to Credit Bureaus. Rent Reporting allows Landlords or Tenants to report on-time, late and missed rent payments to Credit Bureaus like Equifax and Landlord Credit Bureau. By doing this, rental payments are added to a Tenant’s credit report, just like most other bills and loans, and can impact their credit scores.

How Rent Reporting Benefits Landlords

Unfortunately, rent delinquency is a common issue faced by Landlords, often leading to financial strain and significant headaches.

EVERY Landlord should be Rent Reporting. Why? Because it prevents delinquencies by encouraging Tenants to pay their rent on time and also provides Landlords with greater leverage to recover unpaid rent.

How you may ask? For Landlords, It holds Tenants accountable, reduces the number of late or missed payments and has shown to be more effective at recovering debts than collection agencies, particularly when used immediately rather than waiting for the debt to grow or an eviction order to be granted after you’re already owed a substantial debt.

By reporting payment history Landlords encourage timely payments, as Tenants know their credit score is at stake. If rent goes unpaid, the debt appears on the Tenant’s credit report for up to 6-7 years, motivating them to either settle immediately or when they need credit or new housing in the future. You don’t need consent to report a debt.

Compared to collections agencies and small claims court, rent reporting is a simpler, low-cost option that you can largely set and forget. Collections agencies may offer no upfront fees, but they take a large percentage of recovered debt. Small claims court provides enforceable judgments but involves time, costs, and difficulty enforcing the order. Of course, a good option may be to take multiple actions at the same time.

How Rent Reporting Benefits Tenants

Rent Reporting benefits Tenants by allowing them to build or improve their credit scores with regular on-time rent payments. Since rent is often the largest monthly expense, reporting these payments helps Tenants build a positive credit history without needing to take on additional debt like credit cards or loans. This is particularly helpful for renters who may not have other credit-building options, such as newcomers to Canada or those with limited credit.

How Rent Reporting Impacts Credit and What Makes a Credit Profile

Credit Bureaus in Canada use various factors to calculate a credit score, with payment history being one of the most significant (accounting for about 35% of the score). Rent Reporting impacts a Tenant’s credit profile by adding these rent payments to their payment history, which can positively influence their credit scores if they pay on time. Conversely, missed rent payments can lower a Tenant’s credit scores.

Founding Story of Rent Reporting

Industries like credit cards, mortgages, and auto loans have long used Credit Bureau reporting, yet rent—one of the largest monthly expenses—was not traditionally included in credit reports. Recognizing this gap, the team at FrontLobby has worked tirelessly for years to trailblaze rent reporting in Canada as a way to revolutionize the rental industry by offering both Tenants and Landlords a way to include rental payment history in the credit system. This innovative approach has improved the rental market, promoting financial responsibility and accountability across the board. Read more about how FrontLobby worked with Equifax Canada to make Rent Reporting a reality.

Comparing the Features and Benefits

A comparison table of FrontLobby, OpenRoom, Chexy, Borrowell

OpenRoom

Chexy

Borrowell

Help Tenants Build Credit

✔

✔

✔

Mission to Improve Rental Housing Industry

✔

✔

Report On-time, Late AND Unpaid Rent Payments Monthly

✔

Prevent Delinquencies Before They Occur (monthly reporting)

✔

Landlords Can Report Debts to Credit Bureaus Without a Judgement

✔

Deal With Delinquencies Immediately vs Incurring More Unpaid Rent, Time, Expense, and Waiting for a Judgement

✔

✔

Requires Judgement

✔

Requires Judgement

Every Creditor Sees Debt (impacting applications to rent, credit cards, auto loans, jobs and more)

✔

Report as a Tradeline (vs lower impact collection record)

✔

✔

✔

✔

Verified Compliance by Provincial & Federal Regulators Keeping Landlords Legally Compliant & Protected

✔

Multiple Tools to Facilitate Current Tenant Debt Recovery

✔

Multiple Tools to Facilitate Former Tenant Debt Recovery

✔

Enables Small Landlords to Access Collections Agency

✔

Tenant Screening Services

Credit Reports, Background Checks Including Judgements, Verified Tenancy Records

Judgements

✔

Judgements

✔

✔

✔

✔

✔

✔

Comparing the Features and Benefits

A comparison table of FrontLobby and OpenRoom

OpenRoom

Help Tenants Build Credit

✔

X

Mission to Improve Rental Housing Industry

✔

✔

Report On-time, Late AND Unpaid Rent Payments Monthly

✔

X

Prevent Delinquencies Before They Occur (monthly reporting)

✔

X

Landlords Can Report Debts to Credit Bureaus Without a Judgement

✔

X

Deal With Delinquencies Immediately vs Incurring More Unpaid Rent, Time, Expense, and Waiting for a Judgement

✔

X

✔

Requires Judgement

✔

Requires Judgement

Every Creditor Sees Debt (impacting applications to rent, credit cards, auto loans, jobs and more)

✔

X

Report as a Tradeline (vs lower impact collection record)

✔

X

Automated Monthly Payment Reminders, Late Payment Warnings, and Debt Recovery Communications

✔

X

Verified Compliance by Provincial & Federal Regulators Keeping Landlords Legally Compliant & Protected

✔

X

Multiple Tools to Facilitate Current Tenant Debt Recovery

✔

X

Multiple Tools to Facilitate Former Tenant Debt Recovery

✔

X

Enables Small Landlords to Access Collections Agency

✔

X

Tenant Screening Services

Credit Reports, Background Checks Including Judgements, Verified Tenancy Records

Crowd Sourced

Judgements

✔

Crowd Sourced

Judgements

✔

X

✔

X

Via Collections

X

✔

✔

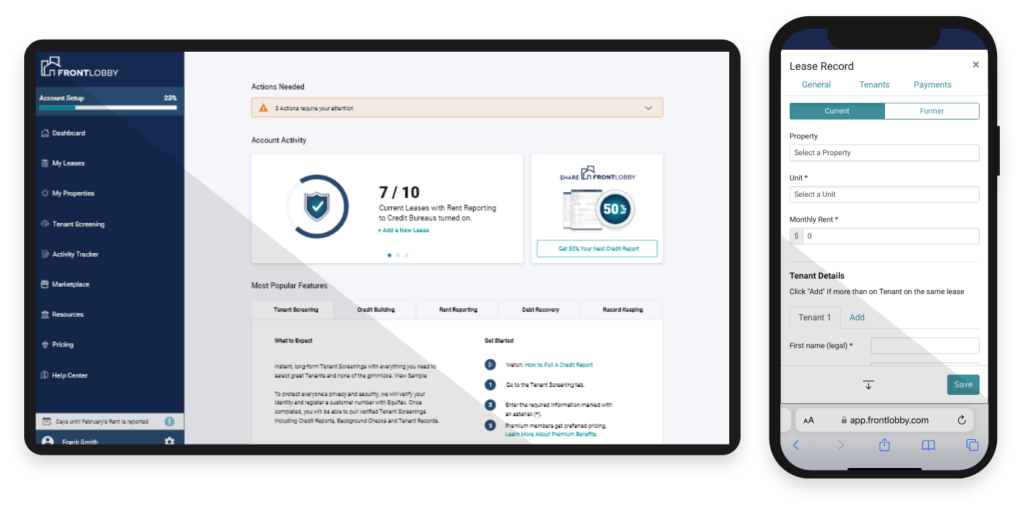

FrontLobby: Canada's Founder of Rent Reporting

FrontLobby, the first, oldest and most established Rent Reporting provider in Canada, started pioneering rent reporting in 2018, allowing Landlords and Tenants to report both on-time and missed payments directly to Credit Bureaus.

Compliance with Privacy and Legal Standards

FrontLobby’s services have been reviewed and verified for compliance by Provincial and Federal regulators, including the Office of the Privacy Commissioner of Canada, ensuring Landlords can be confident when using FrontLobby’s platform.

Proven Credit Impact

FrontLobby is the only rent reporting company in Canada backed by an Equifax study, showing that its Rent Reporting platform actually impacts Tenants’ credit scores.

Broad Coverage Across Tenant Lifecycles

FrontLobby offers a full spectrum of services from screening potential Tenants, to reporting rent payments to Credit Bureaus, to debt recovery. This comprehensive lifecycle management is not offered by any competitors.

Focus on Smaller Landlords

While FrontLobby serves every size Landlord or Property Manager, it focuses on supporting small housing providers (1+ units) and is the only platform able to do so, a unique advantage in the Rent Reporting space.

Reporting Without Court Orders or Consent

FrontLobby enables Landlords to report unpaid rent to Credit Bureaus without needing a court ruling or Tenant consent for the purpose of collecting the debt, simplifying your debt recovery.

Incentivizing Positive Tenant Behavior

FrontLobby’s system of reporting rent payments—both positive and negative—helps create a responsible rental environment. Tenants are motivated to make timely payments to build their credit, which benefits both Landlords and renters long-term. From a housing supply and quality standpoint, FrontLobby helps increase the supply and quality of rental housing. FrontLobby substantially reduces the risk and cost of delinquent Tenants which encourages more rental housing to be created, enables smaller Landlords to afford to continue providing rental housing (e.g. basement suites), and enables all Landlords to afford more repairs & improvements and even reduced rent prices. The small percentage of individuals who are intentionally delinquent, cost the rental housing industry over $3 Billion per year in Canada which impacts the housing supply for everyone.

Borrowell: Tenant Self-Managed Reporting

Borrowell’s Rent Advantage was developed after testing Rent Reporting services in collaboration with FrontLobby.

Self-Reported Rent Payments

Borrowell’s Rent Advantage allows Tenants to report their rent payments to Equifax Canada without requiring Landlord participation.

Building Credit Through Past and Current Payments

Borrowell’s Rent Advantage offers the ability to report both current and up to 24 months of past rent payments. Reporting past payments might help Tenants extend their credit history, improving factors that influence credit scores such as payment history and account age.

No Landlord Involvement

Borrowell’s Rent Advantage does not involve Landlords in the reporting process. While this offers Tenants the convenience to report their rent payments independently, it also raises concerns for Landlords. Since Tenants manage the reporting themselves, there is nothing stopping a Tenant from halting Rent Reporting if they decide to stop paying rent, which could limit the transparency Landlords rely on to track payments.

Money-Back Guarantee

Borrowell offers a money-back guarantee for Tenants reporting past rent payments—if reporting does not lead to an increase in the credit score after at least 12 months of payments, they will refund the fee.

Chexy: Rewards for Tenants

Rent Reporting for Credit Building

Chexy allows Renters to opt-in to report their on-time rent payments to Equifax, one of the major Credit Bureaus in Canada.

Financial Flexibility for Renters

Chexy enables Tenants to earn rewards with popular loyalty programs, such as Aeroplan and AMEX, by paying rent through the platform. These rewards can help offset the cost of rent or other expenses.

Low Fees and Broad Payment Options

Renters can use Chexy to pay their rent with credit cards at a lower fee (1.75%) compared to other payment platforms, and there are options for debit payments as well, making it accessible for a wide range of users.

Supporting Homeownership Goals

Chexy’s long-term vision includes helping Tenants transition to homeownership by building credit through rent payments and saving on essential expenses, creating a path toward financial empowerment .

OpenRoom: Crowdsourced Judgements

Compiling Orders

Openroom is crowd sourcing a database of tenancy-specific judgements, similar to what is available on Canlii.org. This helps Landlords when screening potential Tenants.

Crowdsourced Court Orders

Anyone can upload documents to the platform, allowing users to search through a database of rental disputes and judgements.

Reporting to Credit Bureaus

OpenRoom is piloting the ability for Landlords to report some rental debts to Equifax. This requires a Housing Provider to submit a court judgment, specific to that Tenant debt prior to reporting. This feature is useful to that subset of housing providers who prefer to wait and go through the process of securing an order before reporting the outstanding debt to Equifax or other Credit Bureaus.

Tool for Selecting Landlords and Tenants

OpenRoom provides Landlords and Tenants with access to rental history and court records, helping both parties make informed decisions when choosing their next Tenant or place to rent.

Which Rent Reporting Provider is Right for You?

When selecting a Rent Reporting provider, it’s important to consider your specific needs as either a Tenant or a Landlord. Each provider offers different features, so evaluating what you require can help guide your decision. Here are some key considerations:

- Are You a Tenant or a Landlord?

If you’re a Tenant, your focus may be on building credit by reporting your rent payments. For Landlords, it’s more about holding Tenants accountable and reducing the risk of late payments. Some providers cater more to Tenants (e.g., Borrowell’s Tenant-centered Rent Advantage), while others, like FrontLobby, serve Landlords with Rent Reporting and Debt Recovery tools. - Do You Need to Report Both On-Time and Late Rent Payments?

If you want to report both on-time and late payments, providers like FrontLobby are ideal. When both on time and missed payments are reported, it helps create a complete rental history, offering a more accurate reflection of the tenancy. - Will you benefit from reporting debts as soon as legally possible?

Reporting rental debt to credit bureaus promptly is crucial for Landlords, and using a service like FrontLobby makes this process seamless and effective. This encourages Tenants to prioritize rent payments to avoid damaging their credit scores. By streamlining the reporting process, FrontLobby ensures that debts are documented quickly, reducing the risk of further nonpayment. This helps Landlords recover owed rent faster and contributes to a transparent rental market, aiding future Landlords in screening Tenants more accurately and efficiently. - Legalities and Proven Reputation

It’s important to select a provider that operates within legal frameworks and has a strong reputation. FrontLobby has been reviewed and verified by regulatory bodies such as the Office of the Privacy Commissioner of Canada, ensuring that Landlords are legally compliant when reporting Tenant information. Its proven track record makes it a trusted choice.

Each provider brings its own strengths to the table, whether it’s helping Tenants build credit through consistent rent payments or supporting Landlords with debt recovery and Tenant screening. However, FrontLobby distinguishes itself as the pioneer of Rent Reporting providers in Canada, offering a balanced and comprehensive solution that not only holds Tenants accountable but also empowers them to build stronger credit histories. At the same time, it equips Landlords with a suite of reliable, proven tools. With its robust services, including Tenant Screening, Debt Reporting, and Credit-building features, FrontLobby sets the standard for transparency and accountability in the rental market, benefiting both Landlords and Tenants alike.

Get Started

Housing Providers join

FrontLobby for free.

Did You Enjoy This Article?

Then You Will Love Our Newsletter