How On-Time Rent Payments Can Boost Tenant Credit Scores

Does paying rent on time build credit? Yes, with Rent Reporting

- FrontLobby

- Published

Table of Contents

Why Are Credit Scores Important for Renters?

Why Link Rent Payments to Credit Scores?

Thin Credit and Invisible Credit: Does Rent Reporting Build Credit?

How Do On-Time Rent Payments Benefit Renters?

What Are Rent Reporting Services?

Why Choose FrontLobby for Rent Reporting?

What Other Value Does FrontLobby Provide?

Why Are Credit Scores Important for Renters?

Good credit scores open doors to many of life’s biggest financial steps—buying a first home, obtaining car or students loans, financing a business. Without a good credit score, these milestones may remain out of reach.

A credit score is based on a person’s credit history, which includes information like number of accounts, total levels of debt, repayment history and other factors. Outside of significant goals, having a good credit score also means qualifying for access to credit cards and other lines of credit, with better terms and lower interest rates. This can save a lot of money in the long run and create more opportunities to build financial security.

For Renters, credit scores are becoming even more important. Today, Tenants are staying in the rental market longer than ever, for a variety of reasons:

- Higher housing prices

- Tougher criteria for obtaining mortgages

- Lifestyle choices such as a desire for greater mobility and flexibility

The result is an increasingly competitive rental market. Landlords and Housing Providers now rely on credit checks to select the most financially responsible Tenants who can show a record of making timely repayments. For Renters who want to enter the property market or be selected for a rental property of their choice, a good credit score can make all the difference.

Why Link Rent Payments to Credit Scores?

Rent is often a Renter’s biggest monthly expense. In fact, typically 30% to 40% of a Tenant’s income goes toward paying rent to their Landlord. Yet historically, rent has not been included in credit scores—even though it is a major monthly financial obligation.

Rent typically consumes 30% to 40% of a Tenant’s income.

Thanks to Rent Reporting, on-time rent payments can now be factored into credit scores. This move is a game-changer for Canada’s 5+ million renting households. A recent poll by Fannie Mae found that:

- Over 80% of Renters want their on-time rent payments factored into their credit scores.

- 79% of Renters recognize that having a higher credit score will provide them with greater financial opportunities.

Rent Reporting rewards Renters who consistently pay their rent on time. Renters often find themselves falling behind homeowners as mortgage payments—unlike rent payments—are automatically recorded by Credit Bureaus and contribute to credit scores. And because Renters pay so much of their income in rent, they may have limited ability to save. Plus, less desirable credit cards and loans mean paying higher interest and fees.

Linking rent payments to credit scores gives Renters access to building credit faster, paving the way to a brighter financial future for themselves and their loved ones.

For Landlords and Housing Providers, offering Rent Reporting motivates Renters to pay on time, reduces delinquencies and costly, time-consuming evictions, and helps with Tenant Screening.

Thin Credit and Invisible Credit: Does Rent Reporting Build Credit?

Building good credit takes time, consistency, a mixture of credit accounts and disciplined financial habits. For example, regularly paying credit card bills on time and in full usually increases a person’s credit score.

Because Renters often face specific financial challenges, they may fall into one of two categories that financial institutions and other lenders consider high-risk:

- Credit Invisibility: According to Equifax© Canada, an estimated 3+ million people in Canada are “credit invisible.” This means they either don’t have an active credit file or the credit information on file is insufficient to generate a credit score.

- Thin Credit: A further 7 million people may have a “thin” credit file, meaning their file has two or less credit accounts. These individuals are considered to have a limited credit history.

Both categories may face the same hurdles as individuals with a low credit score—difficulty accessing credit products and housing and having to pay higher interest rates, which can perpetuate a cycle of financial stress. Even if these consumers reliably pay their rent and utility bills, they may still not be seen as creditworthy.

Two groups are particularly likely to be classified as credit invisible or having thin credit: young people who are just starting out, and newcomers who are building a Canadian credit history from scratch.

For people with limited or no credit history, having their on-time rent payments reported to Credit Bureaus can also help them to build credit with payments they are already making. This reduces the burden of needing to apply for credit cards or other credit products—which may lead to incurring debt and further financial stress. People who are starting over in the credit-building process can also benefit.

A recent multi-year tradeline study by Equifax Canada and FrontLobby of Renters who use the FrontLobby rent reporting platform found that 48% were scoreable based solely on rental data reported into Equifax. This means that these individuals have no other credit accounts listed in their Equifax credit report and are only able to build their credit scores using FrontLobby. If they stopped reporting their rent payments and did not add other credit accounts, these Renters could become credit invisible over time.

This study is the first of kind in Canada to investigate the impact of rent payment history on credit scores.

How Do On-Time Rent Payments Benefit Renters?

Reporting on-time rent payments to Credit Bureaus has been proven to help Renters establish, maintain, and improve their credit scores.

A good credit score in turn helps Renters unlock many financial perks and advantages:

- Lower Interest Rates: With lower interest rates on mortgages, car loans, and personal loans, monthly payments decrease, freeing up more of a Renter’s budget for savings and expenditures.

- Favourable Credit Terms: Increased approval odds for credit enables Renters to make informed financial decisions for their future, whether they’re pursuing further education, home improvements, or a new vehicle.

- Expanded Credit Limits: Renters could become eligible for higher credit limits automatically, granting greater financial flexibility during emergencies and making it easier to maintain a reasonable credit utilization rate.

- Premium Financial Products: Chances of qualifying for premium credit cards, such as rewards and cashback cards, as well as other top-tier financial products, can significantly improve.

- Rental Applications: Landlords often request a copy of a Renter’s credit report as part of the rental application process. A strong credit history can show that a Renter is a dependable Tenant.

What Are Rent Reporting Services?

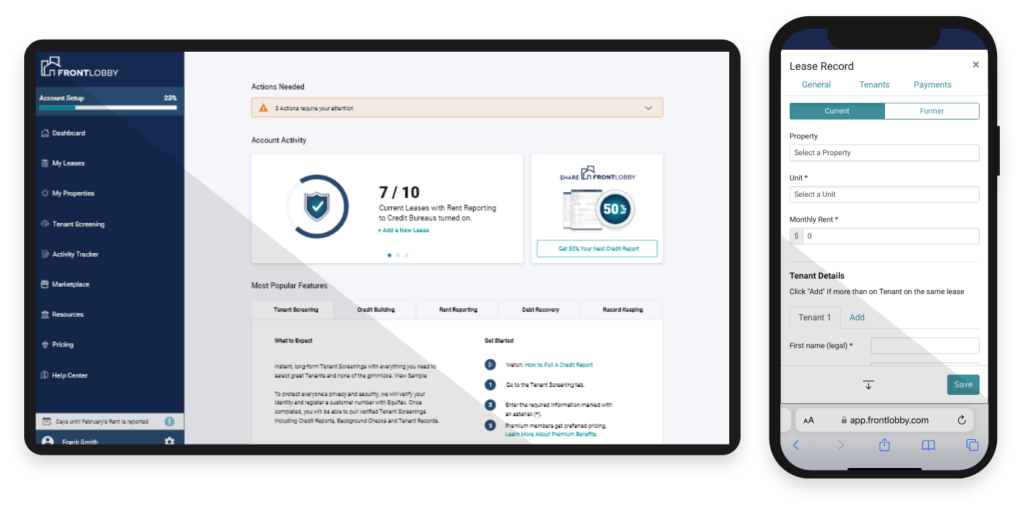

Rent Reporting services like FrontLobby provide a simple, straightforward way for both Tenants and Landlords to report rent payments.

As Canada’s rental market continues to change and evolve, Rent Reporting is gaining traction. Renters value the opportunity to build credit with payments they are already making, and Landlords value being able to attract trustworthy Tenants who are motivated to enhance their credit scores.

Why Choose FrontLobby for Rent Reporting?

Renters using FrontLobby have reported credit scores jumps of 36 points to 84 points in the first 6 months. Overall, FrontLobby users report an average increase of 68 points.

Renters using FrontLobby see their credit score increase by 68 points on average.

FrontLobby is the pioneer of Rent Reporting in Canada and has helped thousands of Renters in reporting their rent and creating a credit history. Monthly payments are reported to Credit Bureaus like Equifax through an easy-to-use online platform. Once an account is set up, there is no need for extra steps or paperwork.

Rent payments then appear on a Tenant’s credit report and can be used when calculating the Tenant’s credit score. Every payment made on time can contribute to building a positive credit history and will accumulate over time to result in a credit score boost.

FrontLobby provides Renters with a detailed overview of their payment history and alerts so that they can always stay up to date on payments, reducing the risk of late or missed payments.

What Other Value Does FrontLobby Provide?

FrontLobby provides much more than Rent Reporting:

- Tenant Records: Through FrontLobby, Renters build a verified Tenant Record with the Landlord Credit Bureau. Tenant records are critical to Tenant Screening. In addition to credit checks, Landlords and Housing Providers review rental history to find out if a potential Tenant has followed lease conditions, kept up with property maintenance, and paid rent on time. Having a verified Tenant Record can help Renters skip the line when applying for their next rental.

Bonus: For Renters who don’t have a good credit score (invisible or thin credit, or low credit score), a Tenant Record allows future Landlords to evaluate them on more than just credit score.

- Comprehensive Tenant Screening: FrontLobby gives Landlords and Housing Providers one-stop access to credit reports from multiple Credit Bureaus, court records, public records, and Tenant Records—speeding up the screening process.

- Debt Recovery: FrontLobby allows Landlords and Housing Providers to report late and unpaid rent to licensed Credit Bureaus—minimizing losses due to delinquency and streamlining the recovery process.

Bonus: FrontLobby offers registered repayment plans to assist with settling debt. When both the Landlord and the Tenant agree to a repayment plan, the Tenant can continue to build credit while the Landlord reduces their Tenant debt.

When Landlords report rent through FrontLobby, their delinquencies can decline by 92%.

FrontLobby was created to improve the rental experience for both Tenants and Landlords. The platform is reviewed and compliance-verified by provincial and federal regulators.

Did You Enjoy This Article?

Then You Will Love Our Newsletter