Tenant Screening Checklist for Landlords and Property Managers in the US

Tenant Screening Services Include Credit Reports

Choosing Tenants who will take care of your property and pay rent on time can be easier said than done. Tenant Screening is a complex process filled with the burden of what can happen if you choose incorrectly. It is important to stay organized and follow a well-designed Tenant Screening process to help judge applicants with ease. A Tenant Screening Checklist will make it easier and faster to assess possible Tenants and will ensure all candidates are evaluated fairly using the same criteria.

Every step of the Tenant screening process is important — including steps like Tenant credit checks, Tenant evictions, and background reports, and income verification — while they might seem tedious, each step is designed to help you choose the right Tenants.

1. Establish Tenant Screening Criteria

Before setting your criteria be sure to consult local laws, it is important to not only be fair during the Tenant Screening process but also follow juridical regulations. For example, some cities restrict Landlords from running a Criminal Background Check on a prospective Tenant or choosing a Tenant based on their Criminal Record.

Every Landlord will have their own set of requirements but a few standard things to include are:

- ✓ Income to Rent Ratio

- ✓ Steady employment (or a co-signer)

- ✓ Rental History

- ✓ Lifestyle requirements (ie: pets or smoking)

- ✓ Attitude and approach to problem-solving

2. Pre-screen Potential Renters

A transparent rental listing that clearly outlines your expectations prevents you from having to show your rental property to every person who shows interest. Including important prerequisites in the rental listing encourages “bad” Tenants (those who have a history of skipping rent payments or damaging rental properties), to self-select out. For example, the listing could state that applicants must submit a rental application, consent to have their on-time rent payments reported to the credit bureaus (Landlord Credit Bureau and Equifax), and authorize a Tenant Credit Check.

Scheduling a phone call before showing the rental will give you the opportunity to ask important questions.

- What is your current living situation?

- Why do you want to move?

- When do you plan on moving?

- What is your monthly income?

- Can you provide references from your former Landlords and employer?

- Will you submit a rental application?

- Will you consent to Rent Reporting to the credit bureaus?

- Will you authorize a Tenant Credit Check?

- Do you have pets?

- Do you smoke?

- Will you have roommates?

3. Tenant Rental Application Form

If the phone call goes well, you can send the prospective Tenant the application form in advance. It is important to include a section where the Tenant gives you consent to pull a Credit Report and Tenant Record. Other important Tenant Screening Checklist questions include:

- Personal Information: Full legal name, current address, phone number, email address and date of birth (i.e. Get a copy of Tenant’s ID)

- Residential history: Landlord’s contact information and previous home address

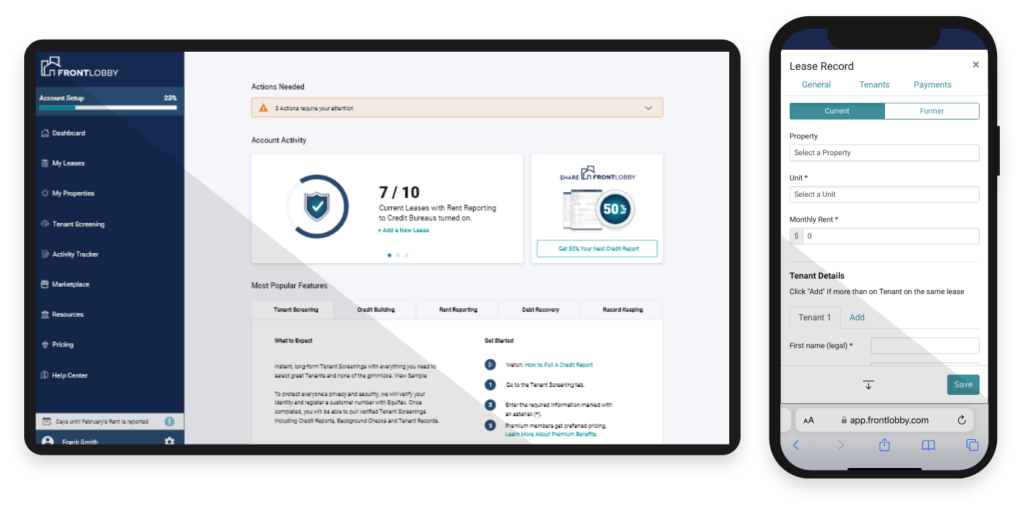

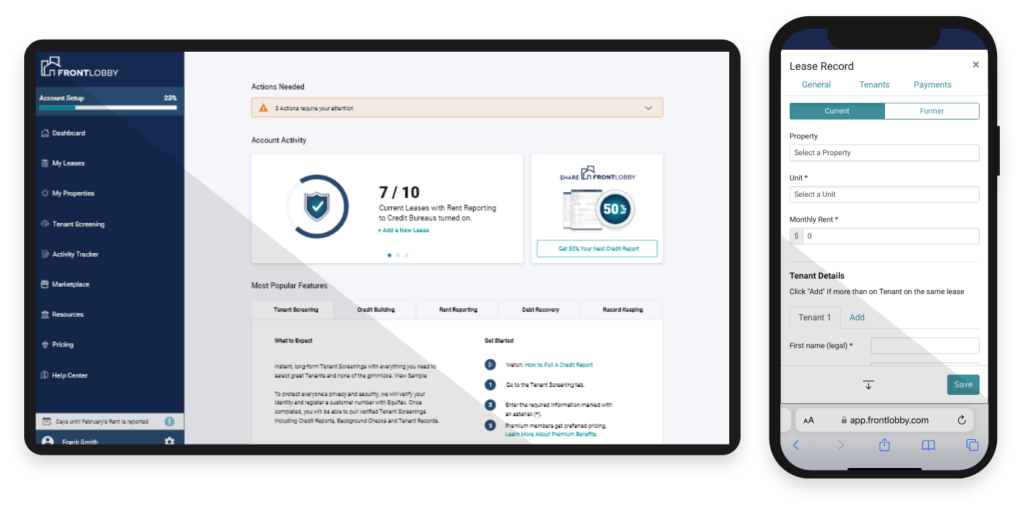

- FrontLobby Lease Record: Proof of previous rental payment history

- Employment/Proof of Income: Current employment, position, supervisor information

- Financial: Any outstanding debt and consent to pull a credit report

- Emergency contact information

4. Show the Rental

A transparent rental listing that clearly outlines your expectations prevents you from having to show your rental property to every person who expresses interest. Including important prerequisites in the rental listing encourages less desirable Tenants to self-select out.

There are a few options when showing your rental, you can do an open house, a block of appointments or individual showings. Meeting potential Tenants in person gives you the opportunity to get to know them. Were they on time? Prepared for the showing? Engaged in viewing the property? All of these answers will help you when selecting the final candidate.

5. Review the Tenant Rental Application

Make sure the Tenant rental application is completed in full before moving on to the next phase of reference checks and Tenant Credit Checks. You may want to include the following Tenant Screening Checklist questions:

- Does the Tenant smoke?

- Has the Tenant ever been evicted?

- Has the Tenant declared bankruptcy?

Once the Tenant rental application is completed, you can begin the final steps in selecting a Tenant.

Employer Reference

Verifying a Tenant’s income and employment with their current employer is an important step in the Tenant Screening process. Understanding if the Tenant has the income to pay rent will give you peace of mind. During the call, you will want to verify certain details including how long the Tenant has worked there as well as the Tenant’s title.

Landlord Reference

A Tenant’s past behavior can help you determine if they are the right fit. Contacting a Tenant’s prior Landlords during your Tenant Screening efforts can help determine what kind of Tenant you can expect. If possible try to contact the Tenant’s current and past Landlords versus just calling their current Landlord, this will help paint the full picture.

When speaking with the Tenant’s current and past Landlords try asking these Tenant Screening Checklist questions:

- Did the tenant pay rent on time?

- Was the property maintained to a reasonable extent?

- What condition was the property left in?

- Were there any complaints from other Tenants or neighbors?

- Would you rent to this Tenant again?

If you are a member of FrontLobby you can pull a Credit Report to ensure you are speaking with the Tenant’s actual prior Landlords and not a fake reference. FrontLobby’s Credit Reports include verified Landlord contact details from Landlord Credit Bureau.

Tenant Credit Check

A Tenant Credit Check might be the last step in your Tenant Screening journey. If you use FrontLobby to perform your Credit Check it will reveal a Tenant’s financial history, current and former addresses, employment confirmation, credit history, credit balances, collections, bankruptcies, inquires, aliases, credit score, and verified Tenant Records from Landlord Credit Bureau.

Why Is A Tenant Screening Checklist Important?

By implementing a standard Tenant Screening process not only will you be more thorough you will also ensure every prospective Tenant is treated fairly. A Tenant Screening Checklist can help keep you organized while you are trying to manage communications, screen Tenants, and choose the right Tenant for you.

Landlords who utilize FrontLobby’s Tenant Screening Services and Rent Reporting functionality are able to attract, choose and retain the best Tenants.

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Get Started

Housing Providers join

FrontLobby for free.

Get Started

Housing Providers join

FrontLobby for free.

Helping Housing Providers and Renters Prosper

Join our mission to improve the rental industry for everyone.