Why Landlords Should Report Rent Payments to Credit Bureaus

Learn How to Report Rent Payments to a Credit Bureau & Why It Matters

- FrontLobby

- Published

- Updated November 19, 2025

Table of Contents

What Is Rent Reporting

Why Rent Reporting Matters for Landlords

How Rent Reporting Helps Landlords Recover Unpaid Rent

How Rent Reporting Helps Landlords Attract Responsible Tenants

How to Report Rent Payments to a Credit Bureau

Free Rent Reporting Lease Clauses

Tools That Support Housing Providers

Reward Responsibility, Reduce Risk

Credit Bureaus That Accept Rent Reporting

Legal Considerations for Rent Reporting

Frequently Asked Questions

Watch: What is Rent Reporting & How to Report Rent Payments to a Credit Bureau?

What Is Rent Reporting?

Rent Reporting is a process where a Landlord, Property Manager, or Tenant shares monthly rent payment information with the Credit Bureaus. For Landlords, it helps reduce delinquencies, support debt recovery, and encourage on-time payments. For Tenants, it can contribute to building a stronger credit profile and unlocking the financial rewards that come with excellent credit. Rent Reporting works much like reporting a credit card or loan and adds structure to the rental relationship.

Key points:

- Tenants or Landlords report rent payments to Credit Bureaus each month

- Both on-time and late payments appear on the Tenant’s credit file

- Landlords can reduce delinquencies and recover unpaid rent

- Responsible Tenants gain credit recognition for payments they already make

- Rent Reporting gives both parties a structured, accountable system

Why Rent Reporting Matters for Landlords

Late rent and unpaid balances are common issues for Landlords. Rent Reporting helps address both by creating accountability. When rent payments affect a Tenant’s credit, rent becomes a priority, Tenants are more likely to pay on time and settle overdue balances faster. In fact, Rent Reporting has been shown to reduce delinquencies by as much as 92% for some Landlords using FrontLobby.

Landlords that report rent payments to a Credit Bureau benefit from:

- Improved cash flow stability

- Reduced stress from rent collection

- Better predictability in monthly income

- Stronger Tenant relationships built on accountability

By using FrontLobby, Landlords can make Rent Reporting part of their monthly process while helping Tenants build credit.

How Rent Reporting Helps Landlords Recover Unpaid Rent

Not all Rent Reporting platforms are created equally, many only record on-time payments and do not allow Landlords to report unpaid rent. This limitation can reduce accountability and leave Landlords without an effective way to recover debts. FrontLobby stands out by offering full-service Rent Reporting that includes both on-time and unpaid rent, giving Landlords a clear advantage.

Unpaid rent can be reported through FrontLobby, and many Landlords find this more effective than traditional collections. In fact, reporting debts through FrontLobby has been shown to be 22 times more effective than traditional collections methods.

When a debt is reported:

- Tenants are notified and often reach out to resolve it

- The debt appears on their credit file

- There’s a structured record for future reference

- It provides a compliant way to report rent payments to Credit Bureaus

- Landlords have the option to introduce a payment plan

This helps Landlords recover rent faster and with fewer barriers. Landlords do not require Tenant consent to report debts through FrontLobby, and a court order is not required. This gives Landlords a simple, compliant way to report unpaid rent and create accountability.

How Rent Reporting Helps Landlords Attract Responsible Tenants

Rent Reporting appeals to Tenants who are financially responsible and want to build credit. When it’s included in a rental listing, it may draw stronger applicants and reduce the risk of late payments.

Benefits include:

- More qualified rental applications

- Tenants who prioritize payment reliability

- Fewer high-risk applicants

- A value-add that highlights Rent Reporting in rental marketing

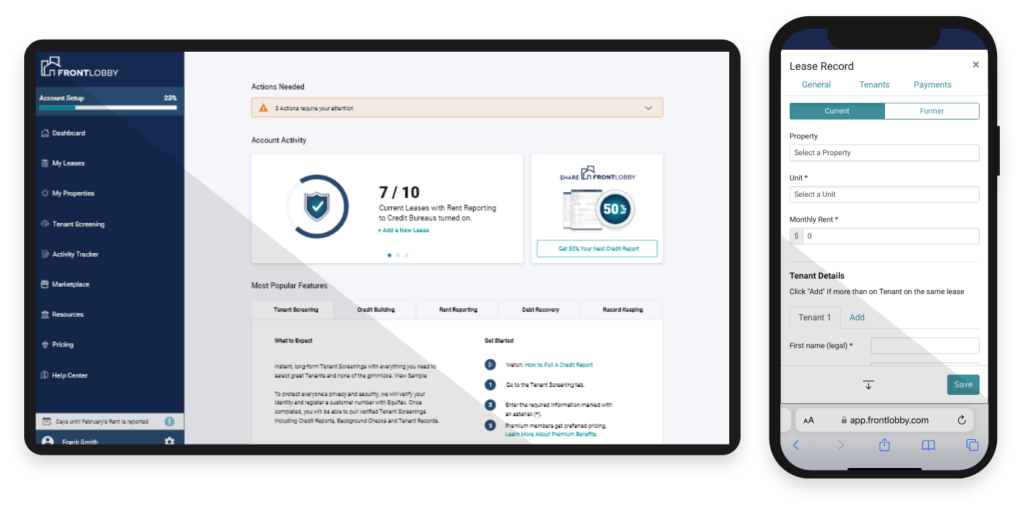

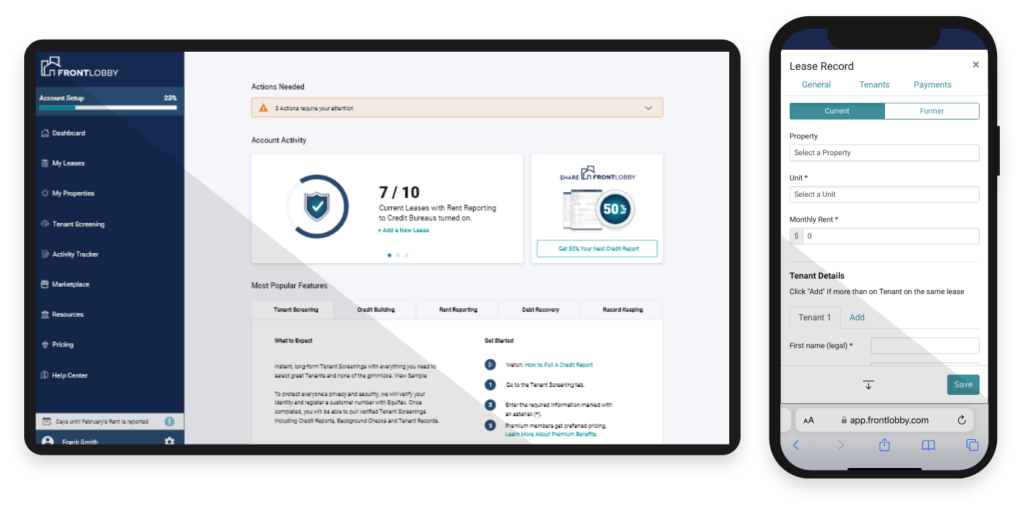

How to Report Rent Payments to a Credit Bureau

Reporting rent payments to a Credit Bureau can seem complex, but the process is simple with the right platform. Rent Reporting helps Landlords reduce delinquencies and maintain consistent payments. Here’s how to report rent payments to a Credit Bureau:

- Create an account with a Rent Reporting platform like FrontLobby.

- Add property and Tenant details.

- Enter monthly rent amounts.

- Log each payment, including missed ones.

- The platform submits the data to the Credit Bureaus.

- Tenant credit files are updated based on Bureau timelines.

The process is simple and designed to fit easily into a Landlord’s routine. FrontLobby provides a straightforward way to report rent payments to Credit Bureaus and strengthen accountability between Landlords and Tenants.

Want to try Rent Reporting? Create your free FrontLobby account to start reporting rent payments to a Credit Bureau today.

Free Rent Reporting Lease Clauses

Setting expectations upfront can lead to better outcomes. While not required, including Rent Reporting clauses in new leases and rental applications can help Landlords explain how Rent Reporting works and ensure Tenants are informed from the beginning.

Tools That Support Housing Providers

FrontLobby also offers tools to help Landlords throughout the rental lifecycle:

- Tenant Screening: Review Credit Reports and Background Checks to choose qualified Tenants.

- Debt Reporting: Report and recover unpaid rent from former Tenants.

- Record Keeping: Store organized payment records for easy reference.

- Landlord Assist: Access reliable guidance for legal and rental questions instantly.

Together, these tools help Landlords manage their properties more efficiently. From screening Tenants and reporting debt to keeping accurate records, each feature supports better decision-making and financial transparency.

Reward Responsibility, Reduce Risk

Rent Reporting helps Landlords promote on-time payments and create a culture of accountability. Learning how to report rent payments to a Credit Bureau supports a balanced system where both Landlords and Tenants benefit. It’s a simple way to encourage financial responsibility and reduce delinquencies. Tenants who pay consistently build credit, while missed payments have real consequences that help restore accountability.

- Up to 92% reduction in delinquencies reported by FrontLobby members

- 68-point average credit score increase for Tenants

- 70% of Tenants say their credit improved after rent was reported

- 77% of Renters are more likely to pay on time when rent is reported

Credit Bureaus That Accept Rent Reporting

Rental payment data can be reported to several major Credit Bureaus, helping ensure that both positive and negative rental histories are reflected on a Tenant’s credit report. These bureaus work with approved Rent Reporting platforms like FrontLobby to incorporate rental data into credit files, offering a standardized and reliable way for Landlords to create accountability and for Tenants to build credit.

- Equifax

- TransUnion

- Experian

- Landlord Credit Bureau

It is nearly impossible for Landlords to report directly to Credit Bureaus without using an approved platform. FrontLobby stands apart because it reports both paid and unpaid rent, requires no minimum unit count, and operates independently of property management software, making Rent Reporting accessible to Landlords of all sizes. Create your free FrontLobby account to start reporting rent payments to a Credit Bureau today.

Legal Considerations for Rent Reporting

Rent Reporting is legal when done through an approved platform like FrontLobby, which follows all compliance and privacy regulations. While it is not mandatory to include Rent Reporting clauses in leases or rental applications, doing so is recommended to maintain transparency and set clear expectations. Legal requirements may differ depending on location, so it’s important for Landlords to stay informed. To learn more about the legal framework supporting Rent Reporting, visit FrontLobby’s Legal Framework page.

Frequently Asked Questions

How do Landlords report rent to a Credit Bureau?

Using a Rent Reporting service like FrontLobby is the most accessible way to report rent payments to a Credit Bureau.

Can any Landlord report rent?

Yes. Any Landlord or Property Manager can report rent through an approved Rent Reporting platform like FrontLobby. These platforms make it possible to share both paid and unpaid rent with Credit Bureaus securely and in compliance with regulations.

Does Rent Reporting help Tenants build credit?

Yes. When on-time rent payments are reported, they can contribute to a stronger credit history and support financial growth for Tenants.

Do Tenants need to agree?

Landlords do not need Tenant consent to report unpaid rent or debts. For on-time rent payments, FrontLobby requests Tenant consent to maintain transparency and align with credit reporting standards.

Can Rent Reporting help reduce delinquencies?

Yes. Landlords using FrontLobby have seen up to a 92% drop in late or missed payments, making it an effective tool for improving rent payment reliability.

How to report rent payments to a Credit Bureau without a Property Manager?

Landlords can report rent payments directly by creating an account with a Rent Reporting platform like FrontLobby, no property management software required.

Watch: What is Rent Reporting & How to Report Rent Payments to a Credit Bureau?

For a concise overview of Why Landlords Should Report Rent Payments to Credit Bureaus and learn how to report rent payments to a Credit Bureau, view the video below.

How to Get Started

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Get Started

Housing Providers join

FrontLobby for free.

Get Started

Housing Providers join

FrontLobby for free.

Did You Enjoy This Article?

Then You Will Love Our Newsletter