Florida Landlords Report

Rent to Credit Bureaus

Reduce your delinquencies, recover unpaid rental debts, and provide Renters with a proven path to better credit.

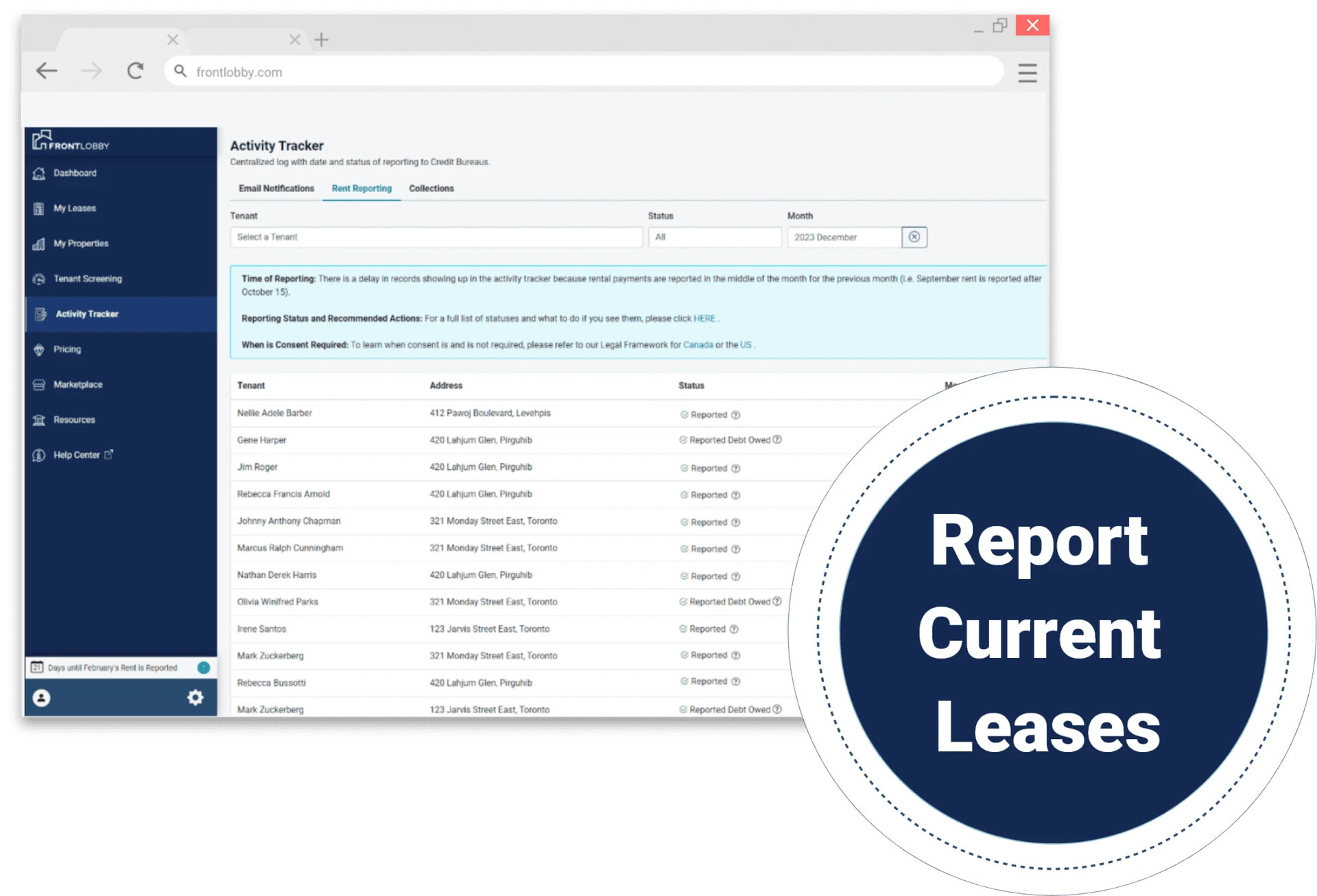

- Report on-time rent from current Tenants

- Report missed rent from both current & former leases

- Improve the industry for everyone

Compliant with

Relevant Legislation

Verified Tradeline

Study by Equifax

Equal Housing

Opportunity Supporter

October 8th, 2024

September 8th, 2024

February 28th, 2024

October 27th, 2024

September 22nd, 2024

April 20th, 2022

June 10th, 2024

October 15th, 2024

February 1st, 2023

October 27th, 2024

September 22nd, 2022

March 7th, 2023

May 23rd, 2021

June 2nd, 2020

November 19th, 2021

May 11th, 2021

August 20th, 2022

July 28th, 2024

June 6th, 2022

February 28th, 2024

April 28th, 2023

November 20th, 2021

January 31st, 2023

March 2nd, 2020

May 25th, 2021

March 20th, 2024

June 4th, 2023

June 2nd, 2021

February 28th, 2024

May 15th, 2023

March 6th, 2021

December 7th, 2022

February 28th, 2024

June 8th, 2023

October 29th, 2022

March 20th, 2024

January 31st, 2022

June 15th, 2024

June 19th, 2023

September 9th, 2022

December 21st, 2022

February 28th, 2024

March 20th, 2024

#1 Florida Rent Reporting Service

Promote industry transparency, Florida Landlords start reporting rent payments to the Credit Bureaus.

Features You'll Love

Report Rent to

Credit Bureaus

Housing Providers and Renters can report rent payments to the Credit Bureaus.

Recover

Unpaid Rent

Report debts to the Credit Bureaus from former lease agreements.

Attract

Quality Renters

Application and lease clauses for reporting rent payments to Credit Bureaus.

Incentivize

On-time Rent

Make rent a priority when it is reported to the Credit Bureaus each month.

How Florida Landlords Report Rent to Credit Bureaus

Rent Reporting

Reporting rent payments to Credit Bureaus in Florida creates an environment where timely payments are valued and respected.

Tenants have the opportunity to improve their credit with every rent payment, much like mortgage payments do for homeowners. For Landlords, it encourages on-time payments, reduces the likelihood of delinquencies and helps with Tenant Screening.

Debt Reporting

In Florida reporting unpaid rent from past leases is an effective solution for Housing Providers with rental arrears.

When unpaid rent is shared with the Credit Bureaus, former Tenants are motivated to settle debts owed. Housing Providers can streamline debt recovery efforts, financial accountability and provide industry transparency.

Trusted By 40,000+ Housing Providers,

With 1,000,000+ Rental Units

How Can Florida Landlords Report Tenants to Credit Bureaus?

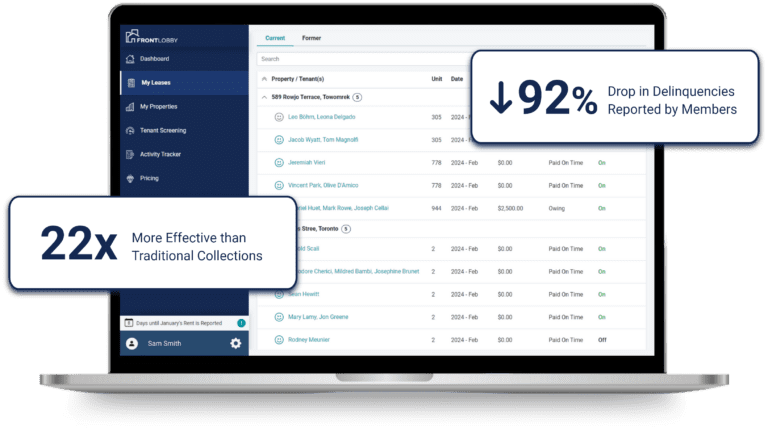

Florida Landlords can report Tenants to Credit Bureaus, effectively minimizing rent defaults and acknowledging reliable Tenants with the opportunity to boost their credit scores. This strategy has proven to reduce payment delays by 92%, and Tenants have seen their credit scores increase by over 60 points.

To start reporting Tenants to Credit Bureaus in Florida, Landlords can utilize a Rent Reporting service like FrontLobby, a platform that bridges the gap between Housing Providers and credit reporting agencies such as Equifax. Learn more about Rent Reporting.

A Tenant Not Paying Rent is Stressful

Mitigate the impact and stress associated with a Tenant not paying rent through effective Rent Reporting services. In Florida reporting rental payments to Credit Bureaus offers Tenants the chance to enhance their credit profiles with rent payment history, simultaneously offering Housing Providers a strategy to diminish rent defaults by encouraging and recognizing prompt rent payments.

FrontLobby collaborates with reporting entities, such as Equifax, facilitating a platform for Landlords to report rent to Credit Bureaus efficiently. Learn how to prevent unpaid rent.

Recovering Rental Debts Through Rent Reporting in Florida

Florida Rent Reporting services provide a powerful tool for Housing Providers seeking to recover rental debts from past Tenants. By utilizing Rent Reporting, they can incentivize former Tenants to settle outstanding balances.

When rental payments, or lack therof, are reported to Credit Bureaus, it can impact the Tenant’s credit score and future credit needs, encouraging Tenants to address unpaid rent. Learn how to recover rental debts.

Ready to Get Started?

Signing up is free and fast. Join us in improving the rental industry for everyone.