Report Unpaid Rent & Recover What's Owed

Take control of Rent Recovery. Maximize your chances of recovering unpaid rent from former Tenants.

- Recover Rental Debts from Past Leases

- Add the Debt to Tenants’ Credit Reports

- 1 Time Fee, You Keep 100% of What You Recover

- No Judgement or Order Required

Compliant with

Relevant Legislation

Verified Tradeline

Study by Equifax

Equal Housing

Opportunity Supporter

December 1st, 2024

December 4th, 2024

December 9th, 2024

November 15th, 2024

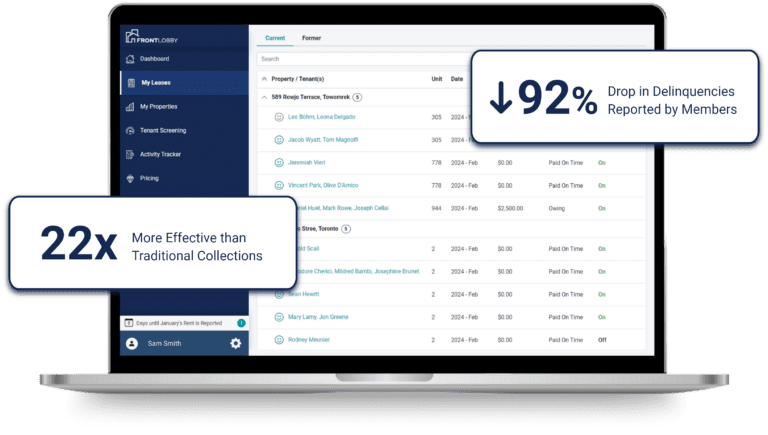

#1 Rent Recovery Solution for Landlords

50,000+ Housing Providers,

Representing 1,000,000+ Units

How To Report A Rental Debt

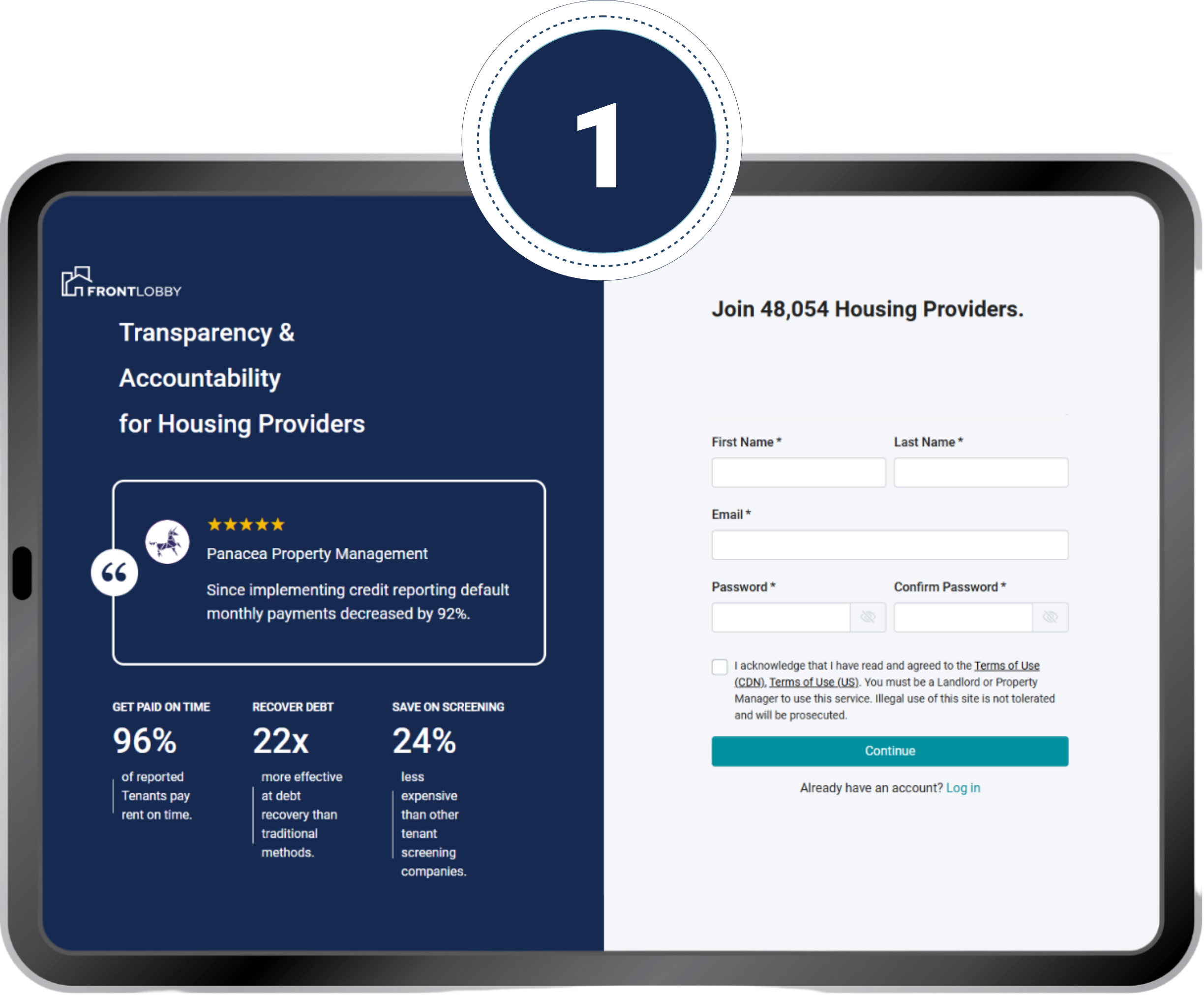

Step 1: Create Your Free Account

Our rent recovery tool is a simple one time charge of $199, or Premium Members pay just $99. The best part, unlike traditional collections agencies you will keep 100% of what you recover.

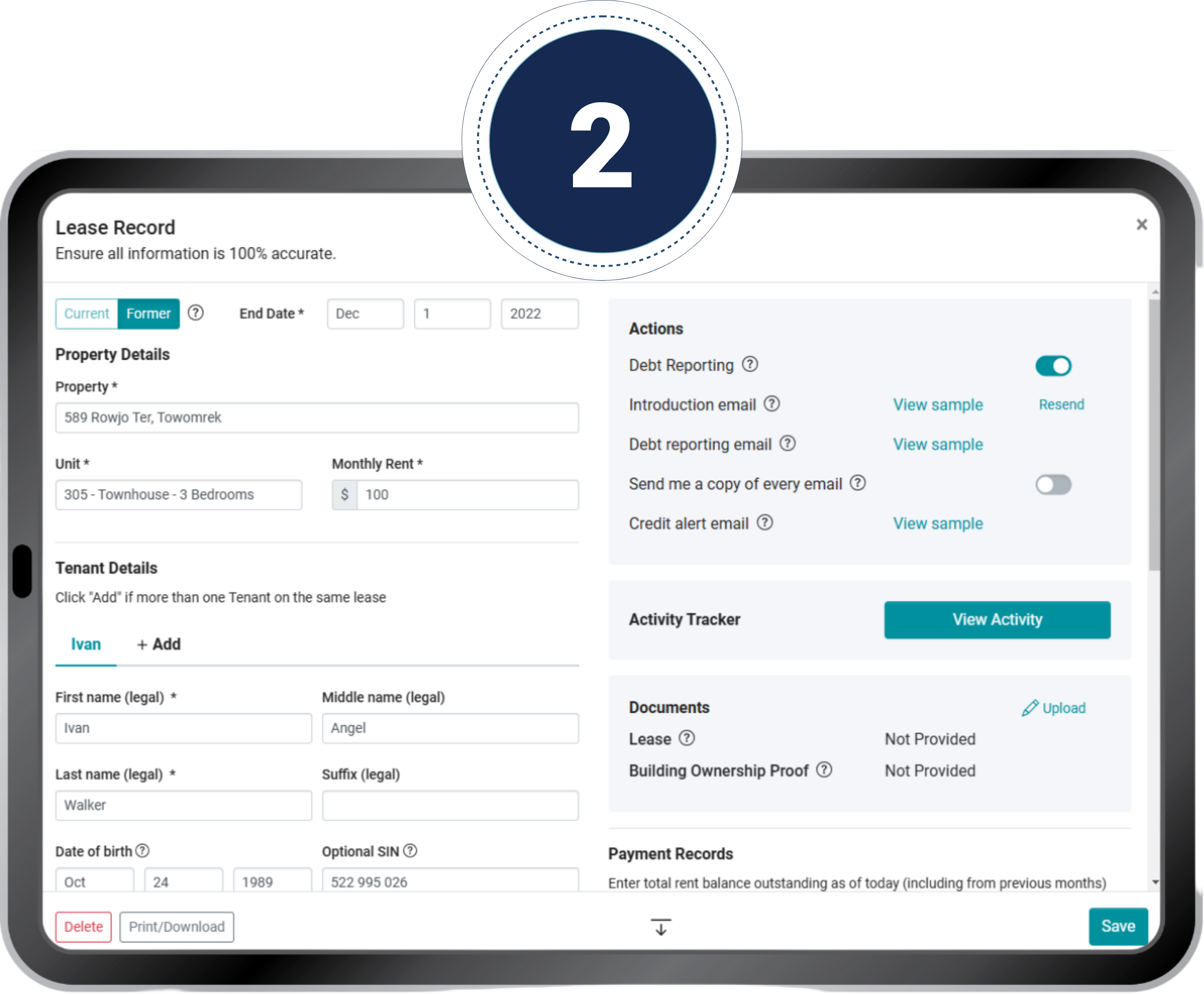

Step 2: Report the Debt

To report the outstanding rent to the Credit Bureaus you’ll need the Tenant’s First Name, Last Name, Email, DOB, and the amount owing. You do not need a court judgment to report the debt.

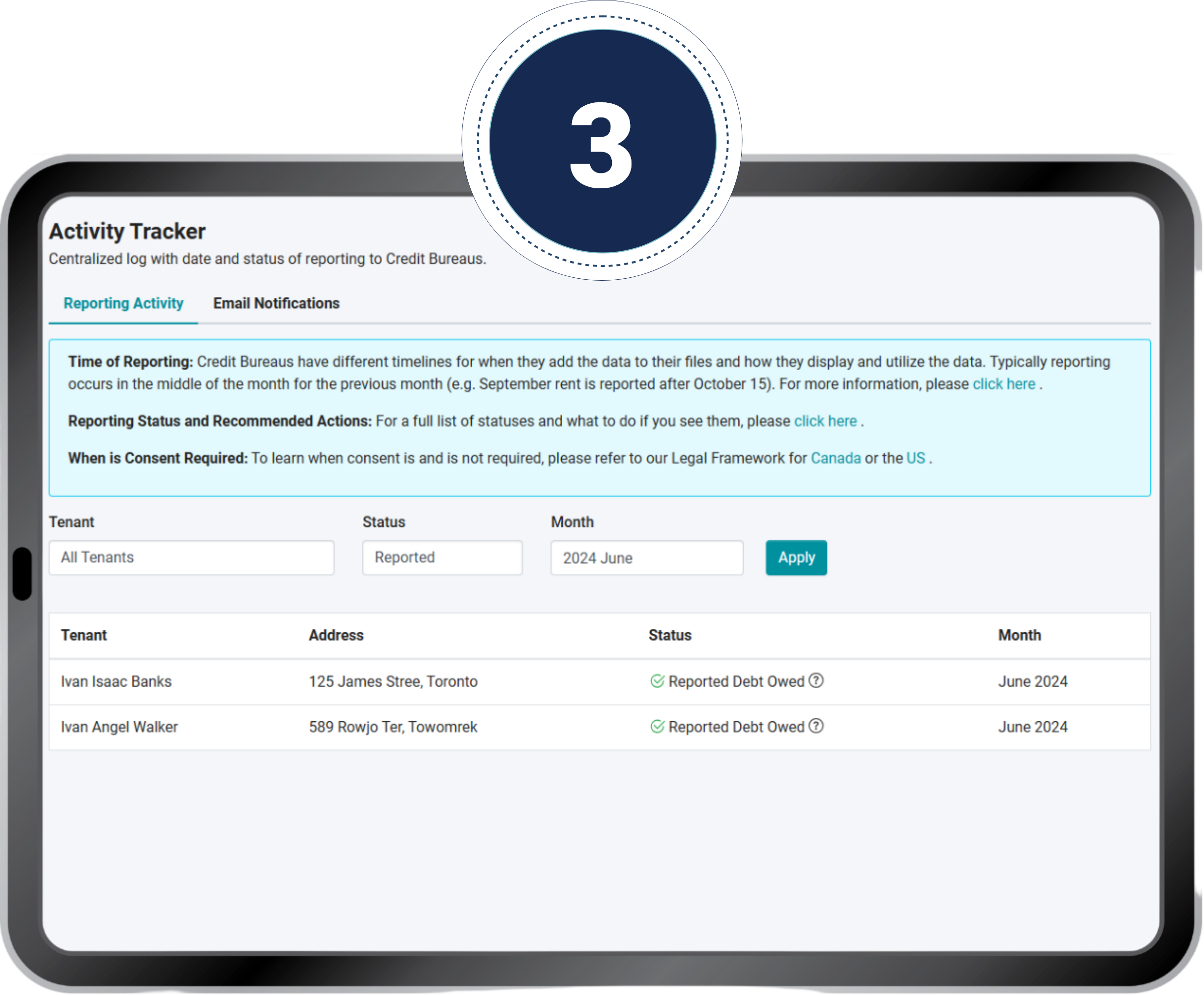

Step 3: Track Activity & Update Debts

Your former Tenant will be notified of how rental debt impacts their credit and that it stays on their credit profile until paid. Login anytime to review communication logs in the personalized Activity Tracker.

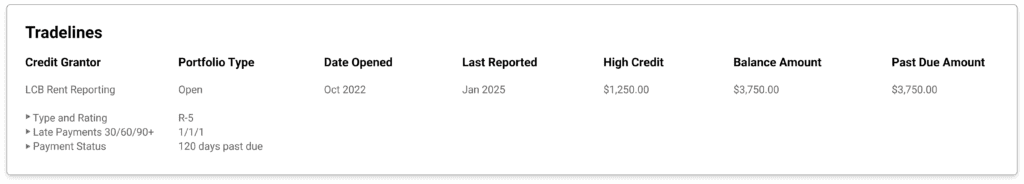

What Does It Look Like?

Rental debts appear on a Tenant's Credit Report under Tradelines, showing the amount of unpaid rent.

Recovering Rental Debts Through Credit Bureau Reporting

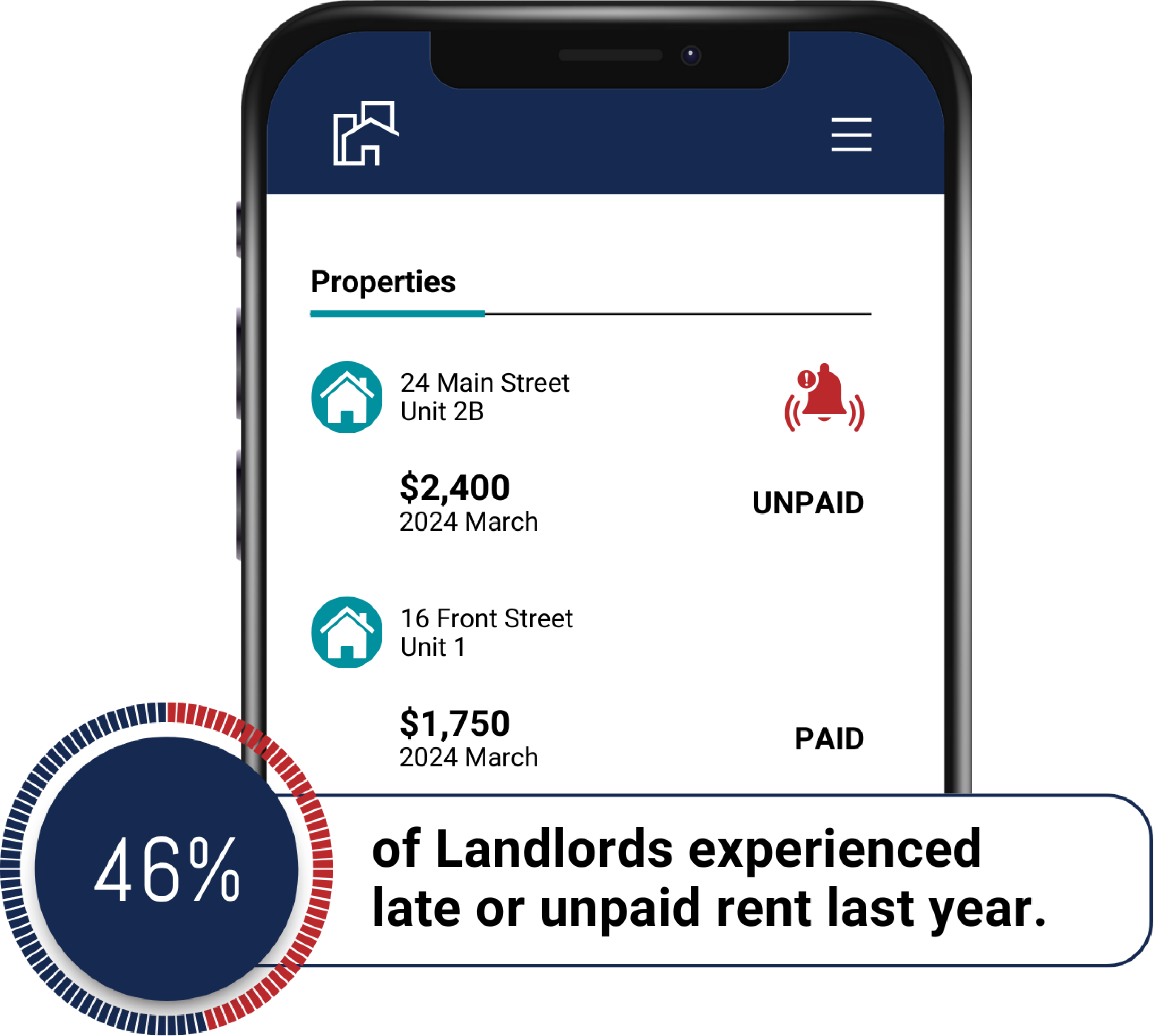

Rent Reporting gives Landlords a simple and effective way to recover unpaid rent from former Tenants. By reporting unpaid balances, you encourage Tenants to take responsibility for what they owe, reminding them that their rent obligations don’t just disappear.

This extra layer of accountability motivates Tenants to pay the rental debt, helping you recover what’s owed. Read more about Why Landlords Should Report Rent Payments.

Rent Recovery Facts

No, FrontLobby does not take a portion of the recovered debt. We charge a one-time administration fee for Debt Reporting services, but any payments made by the Tenant go directly to the Landlord or Property Manager—no commissions or percentages taken.