Top US Rent Reporting Agencies Compared

FrontLobby, Esusu, Rental Kharma, Rent Reporters, RentRedi and Boom Pay

- FrontLobby

- Published

Table of Contents

Understanding the Value of Rent Reporting

What is Rent Reporting and How Does it Work?

Rent Reporting Benefits for Landlords

Rent Reporting Benefits for Tenants

What Are Rent Reporting Agencies?

Comparing the Features and Benefits

Top Rent Reporting Agencies of 2025 in the US

Rent Reporting Agencies

FrontLobby: Most Comprehensive Reporting

Esusu: Best for Building Credit Only

Rental Kharma: Most Past Rent Reporting Options

Rent Reporters: Most Flexible Subscription Guarantee for Tenants

RentRedi: Best for Property Managers with Large Portfolios

Boom Pay: Most Value for Tenants

Which Rent Reporting Provider is Right for You?

Understanding the Value of Rent Reporting

Rent Reporting is becoming an essential tool for both Landlords and Renters. In the past, rent payments were not reported to Credit Bureaus at all. Whether rent was paid on time or missed, it had no impact on a Renter’s credit history unless the debt was sent to a collection agency or became part of a legal judgment. As a result, Renters who paid on time received no credit benefit, and Landlords had limited ways to encourage timely payments.

Rent Reporting agencies help fix this gap by making it possible to share verified rent payment history with major Credit Bureaus. This helps Landlords reduce missed payments and gives Renters a real opportunity to build or improve their credit. Since rent is often the largest monthly expense, it should help support financial progress when paid on time.

What is Rent Reporting and How Does it Work?

Rent Reporting is a relatively new tool designed to empower both Landlords and Tenants. In essence, it involves reporting rental payment activity to at least one and, in some cases, all major Credit Bureaus. Since its inception in 2010, Rent Reporting has grown into a widely accessible option offered by many Landlords and Property Managers. For Renters, it provides a meaningful way to build credit through positive payment habits.

For Landlords, Rent Reporting is a powerful incentive for on-time payments. It also creates a reliable record of payment history, making it easier to monitor rent activity and take early action if issues arise.

This is especially important in California, where Assembly Bill 2747, effective April 1, 2025. This requires many Landlords to offer Tenants the option to report their rental payment history to at least one major Credit Bureau, helping promote financial inclusion and support credit-building opportunities for Tenants.

Rent Reporting Benefits for Landlords

Landlords often find themselves on the receiving end of bad debt when it comes to rent collection. Although common, it’s not the ideal problem to have. Uncollected rent leads to financial strain and rental debt is a threat to the property’s profitability and cash flow.

One effective solution is Rent Reporting, not just for tracking on-time payments, but also for holding Tenants accountable when rent is missed. With modern Rent Reporting tools, Landlords can now report both positive and negative rental payment activity, including unpaid rent, directly to the Credit Bureaus. This added layer of accountability can help reduce delinquencies and improve recovery outcomes.

Unpaid rent can remain on a Tenant’s credit report for up to seven years. Knowing this, many Tenants are motivated to pay on time or settle past-due amounts. By reporting the debt themselves, with a service like FrontLobby, Landlords can often avoid the need for collection agencies or small claims court, saving time, money, and stress.

When reporting did not exist, it left an opening in the system that had no reinforcements for negative payment activity or added benefits to the Tenants who displayed positive payment behavior. Now, with Rent Reporting, the rewards for timely payment history is a positive impact to their credit profile.

Rent Reporting Benefits for Tenants

As a Tenant, one’s monthly rent payment is likely the largest monthly expense. Rent Reporting provides the opportunity to make these payments count towards their credit profile and is the ultimate credit building hack.

In an economy where purchasing a home is becoming more of a marathon than a sprint, renting has cemented its place among housing options. Although it has become more challenging for the average first-time homebuyer to enter the market, it is by no means impossible. In response, Rent Reporting agencies have become valuable tools in property management—modernizing the rental experience and supporting greater financial inclusion.

What Are Rent Reporting Agencies?

Consider Rent Reporting agencies as the essential link between Landlords and the Credit Bureaus. It bridges a gap that neither party can easily cross alone. Credit Bureaus are traditionally set up to receive data from large financial institutions, not individual property owners or small-scale Landlords. As a result, even if a Landlord wanted to report rental payments, or missed payments, there’s no direct or standardized pathway to do so. Likewise, Tenants rarely have the tools or access to ensure their rent payments contribute to their credit profile.

Rent Reporting agencies solve this disconnect by acting as a designated reporting channel. They collect, verify, and transmit rental payment data on behalf of Landlords. Through Rent Reporting, Landlords can:

Report Payment Data: Rent Reporting agencies report on-time, late and missed payments to Credit Bureaus, generally to at least one (if not all) of the three major bureaus: Experian Transunion and Equifax.

Help Build Credit: Through active monthly reporting, Tenants build their credit profile with consistent positive payment history.

Added Tenant Screening: Some Rent Reporting agencies allow Tenant Screening for potential new Tenants and can also help identify a potentially more reliable applicant based on reported payment history.

Comparing the Features and Benefits

There are many Rent Reporting agencies, but they aren’t all the same. Let’s review some of the most notable agencies and how they stack up in the areas that hold the most desired collective benefits for Landlords and Property Managers: Credit Bureau coverage, pricing, affordability, credit impact and reporting features, plus extra tools and services:

Top Rent Reporting Agencies of 2025 in the US

- FrontLobby: Most Comprehensive Reporting

- Rental Kharma: Most Past Rent Reporting Options

- Esusu: Best for Building Credit Only

- Rent Reporters: Most Flexible Subscription Guarantee for Tenants

- RentRedi: Best for Property Managers with Large Portfolios

- Boom Pay: Most Value for Tenants

Rent Reporting Agencies

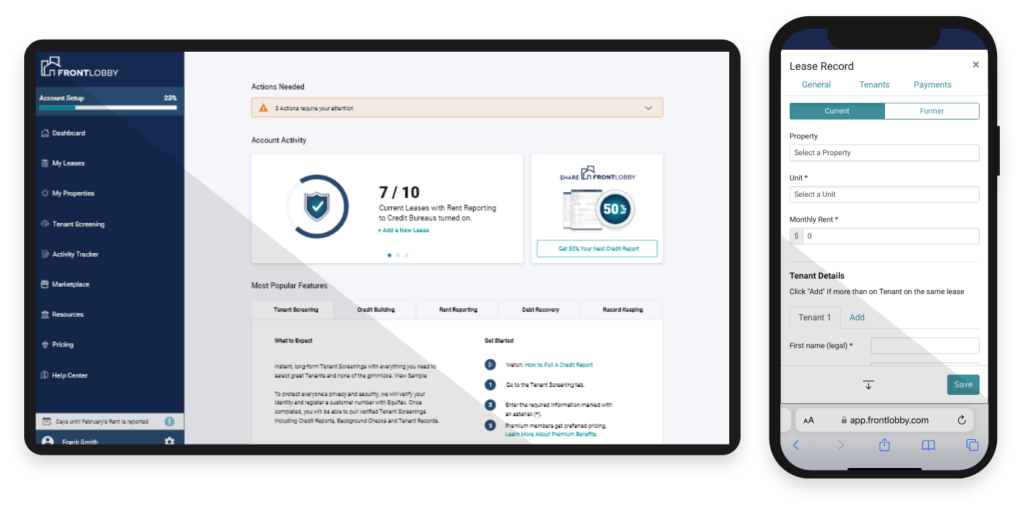

FrontLobby: Most Comprehensive Reporting

Cost for Landlords: $19.90 monthly (billed annually) for up to 20 leases

Cost for Tenants: $4.00 monthly (billed annually)

FrontLobby offers one of the most comprehensive Rent Reporting services available, and it’s one of the few platforms designed to serve both large Property Managers and small, independent Landlords. What sets FrontLobby apart is its ability to report both on-time and missed rent payments. While most platforms only recognize positive payment history, FrontLobby helps Landlords hold Tenants accountable for unpaid rent, improving recovery rates and encouraging timely payments.

The platform reports to all three major credit bureaus, Experian, Equifax, and TransUnion, as well as the Landlord Credit Bureau, giving renters a meaningful way to build or repair credit. In fact, FrontLobby users report an average 68-point credit score increase over six months, and nearly half of Tenants who previously had no scoreable credit history gain one through the service. For Landlords, this can translate into more reliable Tenants and fewer missed payments.

Beyond Rent Reporting, FrontLobby offers additional tools such as Debt Reporting for former Tenants, Tenant Screening Services, and streamlined Recordkeeping. It also integrates with most property management software, making it easy to automate rent reporting and simplify day-to-day operations. Altogether, FrontLobby delivers real value to both Landlords and Tenants, contributing to healthier rental portfolios and stronger financial outcomes.

Credit Bureau Reporting Coverage

- Reports to Equifax, Experian, TransUnion and Landlord Credit Bureau

Pricing and Affordability

- Landlords: $19.90 monthly (billed annually) for up to 20 leases | Tenants: $4.00 monthly, billed annually

Credit impact and reporting features

- Avg. 68-point increase

- 48% of users scoreable after 6 months

- Reports both positive and negative rental payments

Available extra tools and services

- Automated Tenant Notifications

- Communication Activity Tracker

- Landlord and/or Tenant can pay

- Members receive additional discounts of up to 50% on Tenant Screening and Debt Reporting

Esusu: Best for Building Credit Only

Cost for Landlords: Contact Esusu for pricing

Cost for Tenants: $2.50 monthly (billed annually)

Esusu takes a slightly different approach. Rather than simply Rent Reporting, it uses that data as leverage for financial freedom and stability. The company was founded on the premise of bridging the wealth gap, from there it focuses on aspects of credit and financial identity to create a healthy profile for its individual users.

The service reportedly helps users see an average increase of 45-points, with a 665 median score for all Tenants who use it. After the recent acquisition of Celeri, an AI-powered fraud prevention service, Esusu has increased its value to Tenants by actively working towards preventing fraud.

Other tools that Esusu offers include access to financial coaching, information referencing rent relief, and access to a marketplace of services that are designed to complement financial freedom and wealth building.

Credit Bureau Reporting Coverage

- Reports to Equifax, Experian and TransUnion

Pricing and Affordability

- Landlords: Contact for Pricing | Tenants: $2.50 per month (charged annually)

Credit impact and reporting features

- 45-point average increase

Available extra tools and services

- Access financial planning tools without a subscription

- Positive Rent Reporting only

- Fraud prevention opt-in

Rental Kharma: Most Past Rent Reporting Options

Cost for Landlords: Contact Rental Kharma

Cost for Tenants: $79.95-$100 registration, $8.95-$13.95/ monthly

Rental Kharma offers reporting to two of the three major Credit Bureaus, Equifax and TransUnion. However, Rental Kharma offers past-reporting, meaning they will report rental activity at sign-in and dating back to the initial lease’s start date, which could be useful for Tenants that have been around for a longer term, at least 24 months.

Besides past-reporting, and an average 40-point increase, they offer a 90-day satisfaction guarantee and a suite of other services to assist with creating healthy credit patterns.

Credit Bureau Reporting Coverage

- Reports to Equifax and TransUnion

Pricing and Affordability

- Landlords: Contact for Pricing | Tenants: $75.00-$100 registration, $8.95-13.95/monthly

Credit impact and reporting features

- Avg. 40-point increase

- Rapid & back-reporting

- Housing voucher support

Available extra tools and services

- A suite of services designed to help Tenant users reach a 720 credit score

- Expedited reporting service for renters

- 1 on 1 credit monitoring

Rent Reporters: Most Flexible Subscription Guarantee for Tenants

Cost for Landlords: Contact Rent Reporters

Cost for Tenants: $94.95 one-time signup fee (3 monthly payments of $31.65 with SmartPay), $8.75 per month (billed annually), $10.95 per month (monthly)

Rent Reporters offers more of an affiliate relationship to Landlords, unlike the more robust partnership that FrontLobby builds on. They submit rental payment data to all three major Credit Bureaus, TransUnion, Experian, and Equifax. Additionally, the service can retroactively report up to 24 months of past rental payment history, through its past reporting. Past reporting applies to current lease, and if the lease prior falls within 24 months of signing up, that rental history can be included as well. However, this only applies to being reported to TransUnion and Equifax.

They advertise that the service not only helps build a better credit profile through Rent Reporting, but that it can also generate a credit profile for those with little to no credit history. Regular reporting through the service can affect a previously unscoreable Tenant’s profile and turn it into one that qualifies for a credit score.

Credit Bureau Reporting Coverage

- Reports to Equifax, Experian and TransUnion

Pricing and Affordability

- Landlords: Contact for pricing | Tenants: $94.95 one-time signup fee (3 monthly payments of $31.65 with SmartPay), $8.75 per month (billed annually), $10.95 per month (monthly)

Credit impact and reporting features

- Up to 10-day update

- 24- month past reporting

Available extra tools and services

- 7-day money-back guarantee

RentRedi: Best for Property Managers with Large Portfolios

Cost for Landlords: Standard: $30 month to month, $120 bi-annually or $144 annually Premium: $504 annually

Cost for Tenants: one-time rent reporting processing fee of $39.99

RentRedi is an all-in-one property management platform tailored for landlords seeking to streamline operations. Its standout feature, Credit Boost, enables Tenants to report on-time rent payments to all three major Credit Bureaus, TransUnion, Experian, and Equifax, potentially increasing their credit scores by up to 26 points over 12 months. This service is Tenant-initiated and focuses solely on positive payment history, without the capability to report missed or late payments.

Beyond rent reporting, RentRedi offers a comprehensive suite of tools, including online rent collection, Tenant screening, maintenance tracking, lease e-signing, and integration with major listing platforms.

Credit Bureau Reporting Coverage

- Reports to Equifax, Experian and TransUnion

Pricing and Affordability

- Landlords: Standard: $30 month to month, $120 bi-annually or $144 annually Premium $504 annually for premium | Tenants: one time $39.99 rent reporting processing fee

Credit impact and reporting features

- Credit Boost- reflects on the Tenants credit profile reports 5-30 days after Landlord reports

Available extra tools and services

- Provides integration ability to multiple apps including accounting, insurance, calendar, maintenance, proof of income verification, payment processing and listing

Boom Pay: Most Value for Tenants

Cost for Landlords: Contact BoomPay

Cost for Tenants: $36 annually, optional one-time $25 past Rent Reporting fee

Boom Pay is a tech-driven Rent Reporting service that reports to Experian, Equifax, and TransUnion. Tenants complete the process by linking their bank accounts; this verifies their identities and accesses their rental information, including pulling rent payment information from an array of options, like Venmo, Zelle and Cash App.

The service reports an average 28-point increase within the first two weeks and reportedly an increase of as much as 125 points for some users. Rent payments can be back-reported for up to two years, like with prior services, with a single $25 payment.

Credit Bureau Reporting Coverage

- Reports to Equifax, Experian and TransUnion

Pricing and Affordability

- Landlords: Contact BoomPay | Tenants: $36 annually, optional one-time $25 past Rent Reporting fee

Credit impact and reporting features

- Reported on average a 28 point increase

Available extra tools and services

- No additional charge for roommate reporting

- Rapid reporting, within 24 hours

- Past Reporting up to 24 months

Which Rent Reporting Provider is Right for You?

As Rent Reporting becomes a powerful tool in Property Management, it’s no longer just about helping Tenants build credit, it’s also about protecting your rental income and reducing risk. Rent Reporting services allow Landlords to encourage on-time payments, deter delinquencies, and recover unpaid rent more effectively.

When choosing a Rent Reporting provider, it’s important to consider which platforms offer the features that matter most to Landlords: the ability to report both positive and missed payments, coverage across major Credit Bureaus, seamless integration with your existing systems, and support for all portfolio sizes. The right service doesn’t just support your Tenants, it supports your bottom line.

Credit Bureau Coverage:

Does the provider report to one, two, or all three major Credit Bureaus? The Renter credit profile comprises all three major Credit Bureaus at the least. Having a balanced Rent Reporting system is crucial to collection efforts for rental debt. It is also attractive to responsible Tenants looking to have their payment history fully reported for their benefit.

Pricing and Scalability:

Is it affordable and sustainable as your portfolio grows? Partnering with a Rent Reporting agency that supports where you are today and your growth is key to a smooth experience across the transition of two units to 100+ units.

Reporting Features:

Are both on-time and late payments reported? While some Rent Reporting agencies focus on all positive reporting, the question has to be asked- who is it benefiting? There is value in providing the opportunity for responsible paying residents to have the ability to report their positive patient history. However, there is a duty for Landlords to protect their assets through many factors, prioritizing debt mitigation and cashflow. Choose a Rent Reporting Agency that provides the balance of positive and negative reporting.

Additional Tools:

Does the service offer screening, debt recovery, or integrations with your software? There’s value to be had in organization and consolidation. Working with a system where all systems are integrated is a superpower, a collective effort for the Resident pipeline (prospect, current and past) to be managed in one place.

Which Rent Reporting Provider is Right for You?

Rent Reporting is no longer a fringe benefit, it has become an industry standard and in some areas a legislative mandate. As a Landlord looking to encourage timely payments and protect your investment, choosing the right Rent Reporting partner is imperative. The right partner looks like a perfect balance between being a rent reporting agency that provides a robust system designed to protect your asset while offering tools that contribute to Tenant motivation as well.

Evaluate your goals, compare the features, and select a provider that aligns with your needs. If you’re seeking the most comprehensive option that serves you and your residents while supporting long-term portfolio health, FrontLobby is a top-tier choice worth exploring.

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Did You Enjoy This Article?

Then You Will Love Our Newsletter