Guide to Free Rent Reporting for Housing Providers

A New Revenue Stream to Maximize Your Property Profits

- FrontLobby

- Published

Table of Contents

Introduction to Rent Reporting to Credit Bureaus

The Growing Trend in the Rental Industry

How to Report Rent Payments to Credit Bureau for Free

Step-by-Step Guide to Free Rent Reporting

Advantages of Offering Free Rent Reporting Services to Tenants

Unlocking New Revenue Avenues with Rent Reporting

The Win-Win Proposition for Landlords

Benefits of Rent Reporting for Landlords

Benefits for Tenants in Having Rent Reported

Industry-Wide Benefits of Rent Reporting

Implementing Rent Reporting Strategies

Paving the Way for Financial Success

In the dynamic landscape of property management, staying ahead often requires innovative strategies. One such avenue gaining momentum is Rent Reporting to Credit Bureaus. Not only does this practice benefit Tenants by helping them build credit, but it can also prove to be a lucrative venture for Landlords and Property Managers.

Introduction to Rent Reporting to Credit Bureaus

Before delving into the details of free Rent Reporting and profit maximization, it is important to establish a foundational understanding of what Rent Reporting entails. In a nutshell, this process involves reporting Tenants’ rent payment history to Credit Bureaus, this information is then incorporated into the Tenants’ credit reports, contributing to their overall creditworthiness.

While traditionally seen as an added service, recent trends suggest a shift towards making Rent Reporting a standard practice in the rental industry.

The Growing Trend in the Rental Industry

The concept of reporting rent payments to Credit Bureaus has been gaining traction across the United States for a few years now. As more Tenants recognize the value of having their rent payments reflected in their credit histories, the demand for this service has increased. Landlords and Property Managers, in turn, are presented with a unique opportunity not only to enhance their Tenants’ financial well-being but also to maximize their own profits.

How to Report Rent Payments to Credit Bureau for Free

Now that we’ve established how Rent Reporting works, the next logical step is understanding how Landlords and Property Managers can report rent payments to Credit Bureaus without incurring additional costs. While the process traditionally involves expenses, a savvy approach can turn it into a profitable endeavor.

By leveraging Rent Reporting services like FrontLobby, Landlords can report rent payments for just $19 a month. As an option, landlords have the flexibility to pass on the nominal cost of rent reporting to their Tenants. This ensures that Tenants who opt for this credit-boosting service contribute to covering its associated expense.

Step-by-Step Guide to Free Rent Reporting

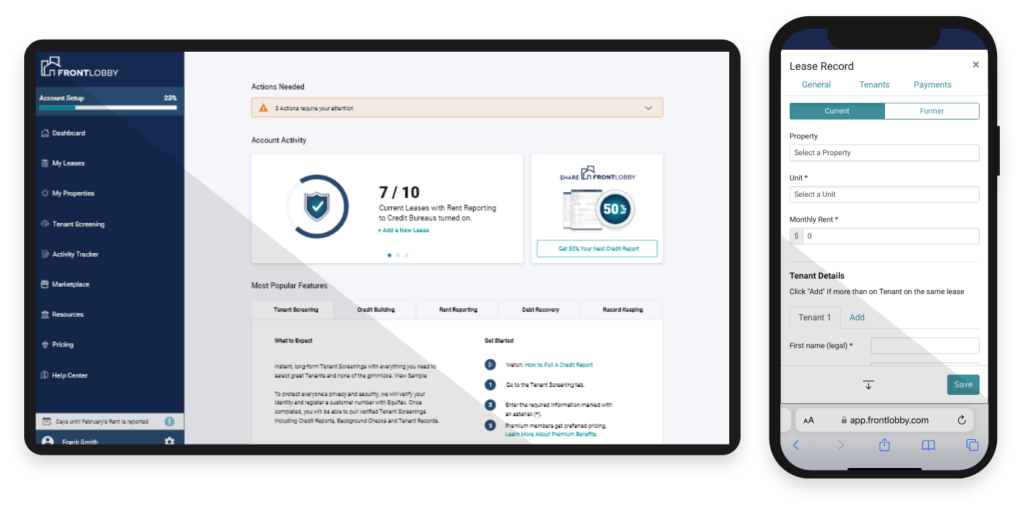

Embarking on the journey of integrating free Rent Reporting into your property management practices doesn’t have to be a daunting task. In fact, it can be both easy and fast, especially with services like FrontLobby at your disposal.

1. Sign Up for FrontLobby: Begin by registering for FrontLobby’s free membership.

2. Set Tenant Fees: Decide what fee you will charge Tenants for Rent Reporting.

3. Automate the Process: Once set up, Housing Providers can manage the system in about five minutes per month.

Advantages of Offering Free Rent Reporting Services to Tenants

Offering free Rent Reporting to Tenants is a strategic move that can yield numerous advantages for Landlords and Property Managers. While it may seem counterintuitive to provide a service without direct compensation, the long-term benefits far outweigh the initial cost.

Tenant Attraction and Retention: The modern Tenant is discerning, often looking for added value in their rental agreements. Providing free Rent Reporting can attract new Tenants and enhance Tenant loyalty.

Tenant Satisfaction: Happy Tenants are more likely to renew leases. Offering free Rent Reporting contributes to overall Tenant satisfaction, fostering positive Landlord-Tenant relationships.

Competitive Edge: In a competitive rental market, Landlords who offer unique and valuable services stand out. Free Rent Reporting can give you a competitive edge in attracting quality Tenants.

Providing free Rent Reporting services to Tenants creates a dual benefit scenario. Tenants receive a valuable service that significantly enhances their creditworthiness, while landlords benefit from the added financial security reporting to Credit Bureaus offers.

Unlocking New Revenue Avenues with Rent Reporting

Housing Providers can unlock a fresh monthly revenue stream by incorporating Rent Reporting into their property management strategy. By passing on the nominal cost of a Rent Reporting Service, such as FrontLobby, and adding a reasonable administration fee, Landlords and Property Managers have the potential to experience substantial returns. FrontLobby’s pricing is intentionally structured to be the most cost-effective in the market, providing Housing Providers with the opportunity to tap into a lucrative new revenue stream.

Take the first step in discovering how much additional revenue you could be earning by filling in the fields below.

The Win-Win Proposition for Landlords

The beauty of this concept lies in its dual benefit – tenants gain a valuable service that positively influences their creditworthiness, while landlords unlock a new revenue stream by incorporating a nominal fee for this added service.

Supplementary Revenue Stream: By reselling rent reporting services, landlords introduce a supplementary revenue stream to their financial portfolio. This goes beyond traditional rent collection, providing an avenue for consistent, incremental income.

Tenant Value Proposition: Offering rent reporting as an optional service enhances the overall value proposition for tenants. This can be particularly appealing in competitive rental markets, attracting responsible tenants who see the additional benefit of building their credit history through on-time rent payments.

Benefits of Rent Reporting for Landlords

Beyond the financial gains, reporting rent payments to Credit Bureaus offers several advantages for Landlords. Let’s explore why this practice is not just about boosting profits but also enhancing the overall Landlord experience.

Building a Positive Credit History for Tenants

Reporting rent payments allows Tenants to build a positive credit history, which is crucial for their financial future. By contributing to this process, Landlords indirectly support their Tenants’ long-term financial goals.

Reducing Late Payments and Encouraging Timely Rent Submissions

One of the notable benefits for Landlords is the potential reduction in payment delinquencies. Tenants are more likely to prioritize timely rent payments when they know their payment history influences their credit score. This can result in a reduction in late payments and ensure a steady and reliable income for Landlords.

Enhancing the Landlord’s Reputation in the Rental Market

Landlords who offer Rent Reporting demonstrate a commitment to Tenant success. This commitment doesn’t go unnoticed in the rental market, contributing to a positive reputation and attracting responsible and reliable Tenants.

Increased Financial Stability

As a Landlord, achieving financial stability is paramount. Rent Reporting contributes to this stability by fostering a payment environment where Tenants are motivated to meet their financial obligations promptly. This reliability enhances the overall financial health of the property and ensures Landlords can confidently plan for the future.

Benefits for Tenants in Having Rent Reported

While there are many advantages for Landlords, it’s essential to understand the significant benefits that Rent Reporting brings to Tenants. This not only makes the practice more compelling for Landlords but also highlights its positive impact on the lives of those leasing the property.

Establishing and Improving Credit Scores

For many Tenants, particularly those without extensive credit histories, Rent Reporting is a game-changer. It provides them with a means to establish and build their credit scores over time. A positive credit history opens doors to better financial opportunities, including easier access to credit cards, loans, and favorable interest rates.

Gaining Access to Better Financial Opportunities

A strong credit score isn’t just a number; it’s a key that unlocks a range of financial opportunities. Tenants with a positive rent payment history are more likely to qualify for competitive interest rates on loans, secure favorable rental terms, and even find it easier to land a job in certain industries where credit checks are common.

Building a Positive Financial Reputation for Future Endeavors

Rent Reporting contributes to the construction of a Tenant’s financial narrative. As Tenants consistently make on-time rent payments, they are actively building a positive financial reputation. This reputation can be invaluable for future endeavors, instilling confidence in potential creditors, Landlords, and employers.

Industry-Wide Benefits of Rent Reporting

As the practice of rent reporting becomes more widespread, the entire rental industry undergoes a transformative shift, embodying principles of transparency, responsibility, and trust.

A Paradigm Shift in Rental Payment Histories

Rent reporting, when embraced on a larger scale, contributes to the creation of a more reliable rental payment history. This shift is not only advantageous for individual landlords but elevates the industry as a whole by fostering a culture of trust and reliability.

Fostering Responsible Financial Behavior

Rent reporting encourages responsible financial behavior among tenants, contributing to a culture of accountability within the rental community. Tenants become more conscious of their payment habits, recognizing the long-term implications on their credit scores and financial futures.

Nurturing a Thriving Rental Ecosystem

As landlords, tenants, and the industry collectively embrace rent reporting, a thriving rental ecosystem emerges. This ecosystem is characterized by transparent financial practices, responsible tenant behavior, and enhanced trust between all stakeholders. The industry, in turn, becomes more resilient, capable of weathering economic uncertainties with greater ease.

In essence, the profound benefits of rent reporting extend far beyond the immediate financial gains, permeating the very fabric of the rental experience. Tenants witness a credit score renaissance, landlords enjoy increased stability and profits, and the industry evolves into a more transparent, responsible, and trustworthy entity. Rent reporting, once seen as a trend, now stands as a beacon guiding the rental industry towards a future defined by financial empowerment and mutual success.

Implementing Rent Reporting Strategies

With the potential benefits of Rent Reporting clear, the next step is implementing effective strategies to seamlessly integrate this practice into your property management processes.

While a common concern among landlords revolves around the perceived complexity of reporting rent payments, innovative services like FrontLobby address this issue head-on, offering a streamlined process that simplifies the entire procedure. With FrontLobby, landlords can efficiently manage Rent Reporting for all their properties, dispelling the notion of complexity. In a remarkably time-efficient manner, spending just about five minutes per month, landlords can effortlessly incorporate this beneficial practice into their routine property management tasks.

Paving the Way for Financial Success

As we navigate the evolving expectations in the rental market, it’s evident that rent reporting isn’t just a trend; it’s a transformative force. Embracing this practice isn’t only about maximizing profits—though that’s undoubtedly a significant benefit—it’s about contributing to a rental industry characterized by transparency, responsibility, and mutual trust.

In this era of information and empowerment, the decision to embrace rent reporting isn’t just a strategic move; it’s a commitment to creating a rental ecosystem where financial success is attainable for all.

Did You Enjoy This Article?

Then You Will Love Our Newsletter