Tenant Screening Best Practices for Landlords and Property Managers

Tenant Screening Services Include Tenant Credit Checks

- FrontLobby

- Published

- Updated June 26, 2025

Table of Contents

1. Set Tenant Screening Criteria

2. Advertise for Qualified Applicants

3. Pre-screen Ad Respondents Over the Phone

4. Send a Tenant Screening Application Form

5. Assess Applicants When They Visit

6. Do a Tenant Credit Check

7. More Than a Credit Report

8. Verify Employment Information

9. Check Landlord References

10. Calculate Payment Ability

11. Obey the Law

BONUS Tip: The #1 Tenant Screening Tool You Need

It's Important to Follow a Trusted Process

When a rental unit becomes vacant, a Landlord or Property Manager needs to fill it with new occupants who will pay their rent on time every month and leave the property in excellent shape. To find Tenants, Property Owners and Managers may be inclined to run an ad, see who turns up to visit, and go with their intuition. But the key to finding a great Tenant is to follow proven Tenant Screening best practices.

The odds of getting a responsible Tenant exceed 90%. However, when Landlords get Renters who pay late repeatedly, miss payments altogether, or damage the property beyond normal wear and tear, it can cost them an average of $11,000 per year.

1/8 Applications Contain

Some Form of Fraud

To attract and choose the right Renters, Landlords need a thorough, and reliable process to screen prospective Tenants. By consistently applying recommended Tenant Screening best practices, Landlords can lower their risk of a costly decision and feel confident about their incoming new Renters.

Tenant Screening Best Practices

1. Set Tenant Screening Criteria

Before advertising their unit for rent, Landlords should decide what kind of Renter they seek. For example, an upscale, modern one-bedroom-plus-den apartment might attract a high-income professional single person or couple.

Then, they should establish income-to-rent standards. The industry standard is a ratio of three to one. For example, if the rent is $2,000 per month, a Landlord might decide that the Tenant should make $6,000 or more per month.

Landlords also should set their rental-history standards. Although, in many cases, Landlords may want a new occupant with an exemplary record that spans many years, they may not be able to get this if they are targeting people new to renting. For example, perhaps the unit is located near a campus and the ideal Tenant would be a student.

2. Advertise for Qualified Applicants

In their listings, Landlords should disclose all relevant information to avoid wasting their time and the candidates’ time.

Property and location details should entice well-fitting applicants and deter unqualified ones. For example, if the unit comes with no parking spot, that should be mentioned so those needing a space for a vehicle need not apply. Or if the unit is located on the third floor of a walk-up building with no elevator, that should be clearly stated. This helps rule out applicants with mobility concerns or those who require accessible housing, saving everyone time and potential frustration.

3. Pre-screen Ad Respondents Over the Phone

Landlords should ask qualifying questions to identify the most suitable candidates. Here are examples:

- “When would you like to move in?” This is the first question Landlords should ask because if their dates do not coincide with the Tenants’, the conversation can stop right there.

- “How long have you lived in your current home?” Landlords seeking a long-term Tenant should listen for signs of “property hopping.”

- “Why are you moving?” Landlords should assess whether the explanation seems reasonable, such as relocating for a job. They should also listen for signs the person is being evicted.

Other good questions to ask are how many fellow occupants will move in with them, whether they smoke or have pets, what their income is, and what draws them to the neighborhood. Knowing the answers to these can help Landlords qualify well-fitting candidates or evaluate their likelihood to stay.

4. Send a Tenant Screening Application Form

Here is something to include in a simple but effective Tenant pre-screening form:

A. Basic Contact Information

- Full legal name

- Email address

- Phone number

- Current residential address

B. Employment Information

- Employer name

- Current job title

- Length of employment

- Approximate monthly income

C. Current Living Situation

- How long they’ve lived at their current residence

- Reason for leaving

- Current Landlord’s name and contact information

D. Rental History (Optional, Brief)

- One or two past addresses

- Duration of stay at each

E. Household Details

- Number of adults and children

- Any pets (type and number)

- Smoking habits (yes or no)

F. Logistics

- Intended move-in date

- Desired length of tenancy

G. Credit Report and Background Check Consent

- Landlords and Property Managers use credit reports and background checks to make informed decisions about prospective Tenants. Reviewing an applicant’s financial and rental history helps ensure they’re reliable and responsible. Including a consent clause up front sets clear expectations and can deter candidates with a poor track record from applying.

Want to get started? Download a free consent clause to include in your rental application and lease agreements.

H. Rent Reporting Consent

- Landlords and Property Managers use Rent Reporting to reward on-time Tenants by reporting Renters’ payments. This helps Tenants build credit and helps Landlords reduce late payments. When candidates who intend to be delinquent see a clause on the application form saying their rent will be reported, they may decide not to apply.

Want to get started? Download a free Rent Reporting clause to include in your rental application and lease agreements.

5. Assess Applicants When They Visit

When candidates come for a property tour, Landlords should try to start a conversation with them. Good open-ended questions to ask include, among others, “Tell me about your job” and “What do you like about this neighborhood?” Landlords should try to fill in any information gaps they have, such as how many people will occupy the unit or how quiet or loud the Tenant is likely to be. This is also a good opportunity to reinforce building policies.

To guard against fraudulent applications, Landlords should ask to see two

pieces of photo identification

6. Do a Tenant Credit Check

Though most Renters are honest, fraud happens all too often, and Credit Reports can be faked. Therefore, even when applicants provide copies of their credit history, Landlords should run their own verification process with the prospective Tenants’ consent.

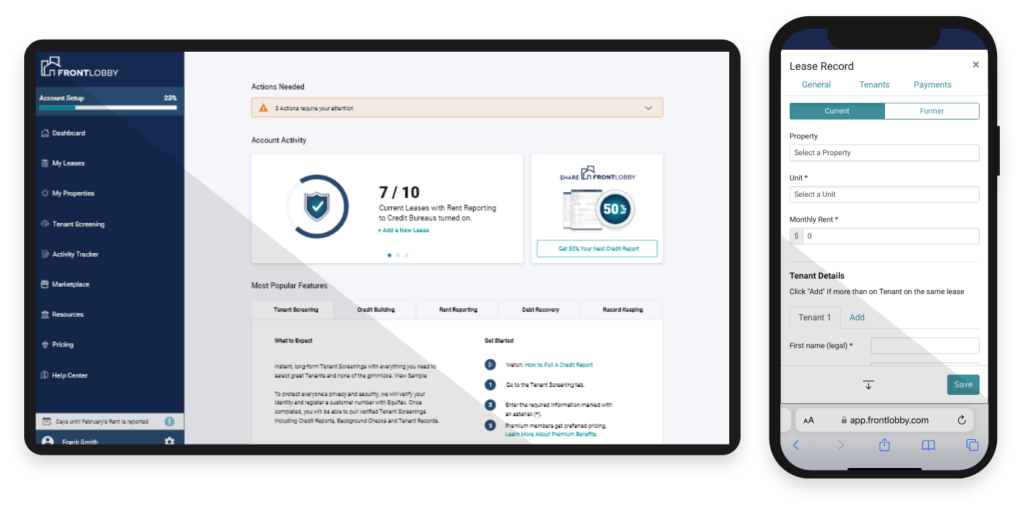

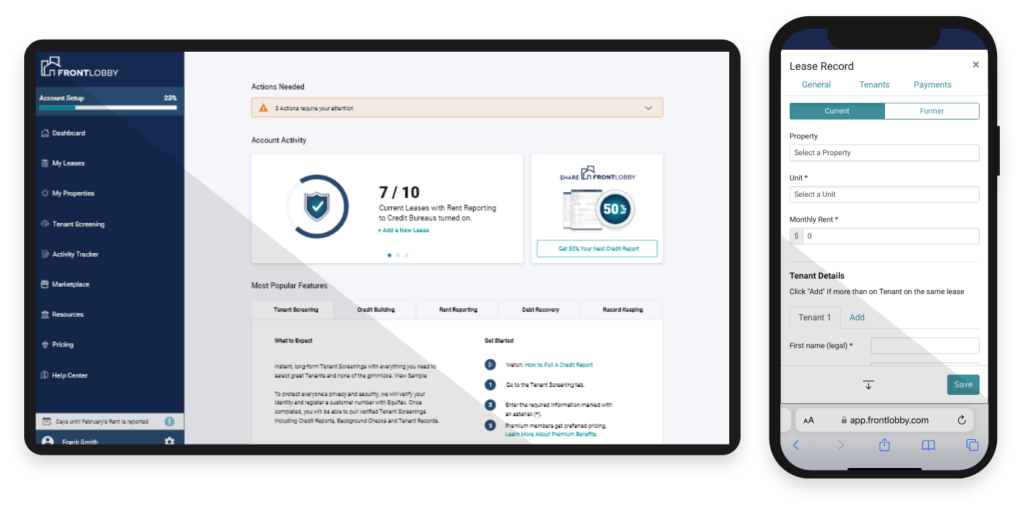

For FrontLobby members, our Tenant screening services include, Credit Checks and Background Checks delivered fast and at an affordable price.

A Tenant Credit Report will show how well the applicant manages their finances and pays off debt. Landlords can look for any financial missteps that make them doubt the applicant’s ability to consistently pay their rent on time.

Landlords should examine the data as a whole and not over-rely on the credit score. Students, immigrants, young people and others new to credit may not have had time to build high scores, yet may turn out to be outstanding Tenants.

Watch: How to Spot Red Flags — Tenant Screening Best Practices Every Landlord Should Know

7. More Than a Credit Report

Before selecting a new Tenant, Landlords should spend a few minutes searching online for any red flags.

For example, they can type the candidate’s name into Google and see whether the results reveal any criminal behavior. LinkedIn is a helpful tool for verifying the applicant’s employer information. (However, Landlords should realize that if they do this while signed on to LinkedIn, the candidate may be able to tell they have viewed their profile.)

8. Verify Employment Information

Landlords should call the applicant’s supervisor to confirm their employment and income. However, they should look for the supervisor’s or company’s phone number online (e.g., on LinkedIn or through a Google search) rather than using the phone number on the application form. In cases of rental application fraud, employer contact information may be fake.

9. Check Landlord References

Again, to counteract the possibility of a fraudulent application, Landlords should search online (e.g., search by address within rental listings) for the applicant’s past Landlords’ phone numbers. Then, they can call the previous Landlords and ask whether the Tenant missed any rent payments, did damage or caused any other problems.

10. Calculate Payment Ability

Once they know the applicant’s employment income and have seen their credit record, Landlords can determine the prospective Tenant’s ability to pay the rent. As a guide, Landlords should use the income-to-rent standards they established earlier in the process, before beginning a candidate search.

11. Obey the Law

Landlords must comply with all applicable federal and state laws when screening Tenants and establishing Tenant screening criteria.

To run a Credit Report, Landlords are legally required to obtain the applicant’s consent. This is typically done on the rental application using a clearly worded clause. If you don’t have one yet, you can download a free credit check consent clause below.

Landlords should be aware of Fair Housing laws, which prohibit discrimination based on race, color, religion, national origin, sex, disability, or familial status. Avoid asking about any protected characteristics, including marital status, religious beliefs, or sexual orientation.

Some states have specific rules regarding pet policies, application fees, and source-of-income protections. As a Landlord it is important to stay up to date on all local and federal laws.

BONUS Tip: The #1 Tenant Screening Tool You Need

The most powerful Tenant Screening tool isn’t a background check or credit score. It’s Rent Reporting. By including a Rent Reporting clause in your rental application, you let Tenants know upfront that their rent payments will be reported to the major Credit Bureaus. This simple step sets the expectation for on-time payments and often discourages applicants who might otherwise skip out on rent. It’s a quiet but effective filter because Renters who don’t plan to pay reliably are less likely to apply in the first place.

FrontLobby makes it easy, you can start reporting Renters’ payments and create a system that rewards good Tenants while holding others accountable. Sign up for your FrontLobby membership to unlock this powerful screening tool.

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Get Started

Housing Providers join

FrontLobby for free.

Get Started

Housing Providers join

FrontLobby for free.

Did You Enjoy This Article?

Then You Will Love Our Newsletter