How On-Time Rent Payments Can Increase Tenant Credit Scores

Do on time rent payments build credit? Yes, with Rent Reporting.

- FrontLobby

- Published

Table of Contents

Why Are Credit Scores Important for Renters?

Why Should Rent Payments Impact Credit Scores?

New to Credit or Poor Credit: Does Rent Reporting Build Credit?

Can On-Time Rent Payments Help Renters?

What Are Rent Reporting Services?

Why Choose FrontLobby for Rent Reporting?

Does FrontLobby Provide Other Services?

Why Are Credit Scores Important for Renters?

Strong credit scores unlock many of life’s major financial milestones—purchasing a first home, securing car or student loans, and financing a business. Without a solid credit score, these opportunities may be difficult to achieve.

In the U.S. a credit score is based on a person’s credit history, which includes information like number of accounts, total levels of debt, repayment history and other factors. Outside of significant goals, having a good credit score also means qualifying for access to credit cards and other lines of credit, with better terms and lower interest rates. This can save a lot of money in the long run and create more opportunities to build financial security.

For Renters, credit scores are becoming even more important. Today, Tenants are staying in the rental market longer than ever, for a variety of reasons:

- Rising home prices

- Stricter mortgage approval requirements

- Lifestyle preferences for more mobility and flexibility

As a result, the U.S. rental market has become more competitive, leading Landlords and Property Managers to rely on credit checks to find financially responsible Tenants with a history of making timely payments. For Renters looking to secure their desired rental or eventually enter the housing market, a strong credit score can be a crucial advantage.

Why Should Rent Payments Impact Credit Scores?

Rent is usually a Renter’s largest monthly expense, often consuming 30% to 40% of their income. However, despite being a significant financial commitment, rent payments have historically not been included in credit scores.

The median monthly rent across the U.S. is $2,002.

Thanks to Rent Reporting, on-time rent payments can now be factored into credit scores. This change is a game-changer for the over 44 million renting households in the U.S. A recent poll by Fannie Mae found that:

- Over 80% of Renters want their on-time rent payments factored into their credit scores.

- 79% of Renters recognize that having a higher credit score will provide them with greater financial opportunities.

Rent Reporting rewards Renters who consistently pay their rent on time. Renters often find themselves falling behind homeowners as mortgage payments—unlike rent payments—are automatically recorded by Credit Bureaus and contribute to credit scores. And because Renters pay so much of their income in rent, they may have limited ability to save. Plus, less desirable credit cards and loans mean paying higher interest and fees.

Including rent payments in credit scores gives Renters access to building credit faster, paving the way to a brighter financial future for themselves and their loved ones.

For Landlords and Property Managers, offering Rent Reporting is a smart way to encourage Renters to pay on time. It not only helps reduce delinquencies but also cuts down on the hassle and cost of evictions. Plus, it makes Tenant Screening easier by giving you a clearer picture of a tenant’s financial habits.

New to Credit or Poor Credit: Does Rent Reporting Build Credit?

Building good credit takes time, consistency, a mixture of credit accounts and disciplined financial habits. For example, regularly paying credit card bills on time and in full usually increases a person’s credit score.

Because Renters often face specific financial challenges, they may fall into one of two categories that financial institutions and other lenders consider high-risk:

- Credit Invisibility: According to Equifax Canada, an estimated 3+ million people in Canada are “credit invisible.” This means they either don’t have an active credit file or the credit information on file is insufficient to generate a credit score.

- Thin Credit: A further 7 million people may have a “thin” credit file, meaning their file has two or less credit accounts. These individuals are considered to have a limited credit history.

Both categories may face the same hurdles as individuals with a low credit score—difficulty accessing credit products and housing and having to pay higher interest rates, which can perpetuate a cycle of financial stress. Even if these consumers reliably pay their rent and utility bills, they may still not be seen as creditworthy.

Two groups are particularly likely to be classified as credit invisible or having thin credit: young people who are just starting out, and newcomers who are building a Canadian credit history from scratch.

For people who are new to credit with limited credit history, having their on-time rent payments reported to Credit Bureaus can also help them to build credit with payments they are already making. This reduces the burden of needing to apply for multiple credit cards or other credit products—which may lead to incurring debt and further financial stress. People who are starting over in the credit-building process can also benefit.

A recent multi-year tradeline study by Equifax and FrontLobby of Renters who use the FrontLobby rent reporting platform found that 48% were scoreable based solely on rental data reported into Equifax. This means that these individuals have no other credit accounts listed in their Equifax credit report and are only able to build their credit scores using FrontLobby. If they stopped reporting their rent payments and did not add other credit accounts, these Renters could become credit invisible over time.

48% were scoreable based solely on rental data reported.

This study is one of kind, investigating the impact of rent payment history on credit scores.

Can On-Time Rent Payments Help Renters?

Reporting on-time rent payments to Credit Bureaus has been shown to help Renters build, maintain, and boost their credit scores.

A good credit score in turn helps Renters unlock many financial perks and advantages:

- Better Interest Rates: With better interest rates on mortgages, car loans, and personal loans, monthly payments decrease, freeing up more of a Renter’s budget for savings and expenditures.

- Improved Credit Terms: Increased approval odds for credit enables Renters to make informed financial decisions for their future, whether they’re pursuing further education, home improvements, or a new vehicle.

- Higher Credit Limits: Renters could become eligible for higher credit limits automatically, granting greater financial flexibility during emergencies and making it easier to maintain a reasonable credit utilization rate.

- Access to Premium Financial Products: Chances of qualifying for premium credit cards, such as rewards and cashback cards, as well as other top-tier financial products, can significantly improve.

- Rental Applications: When applying for a rental property, Landlords often review a Renter’s credit report. A solid credit history can demonstrate reliability, making it easier to secure the desired rental.

What Are Rent Reporting Services?

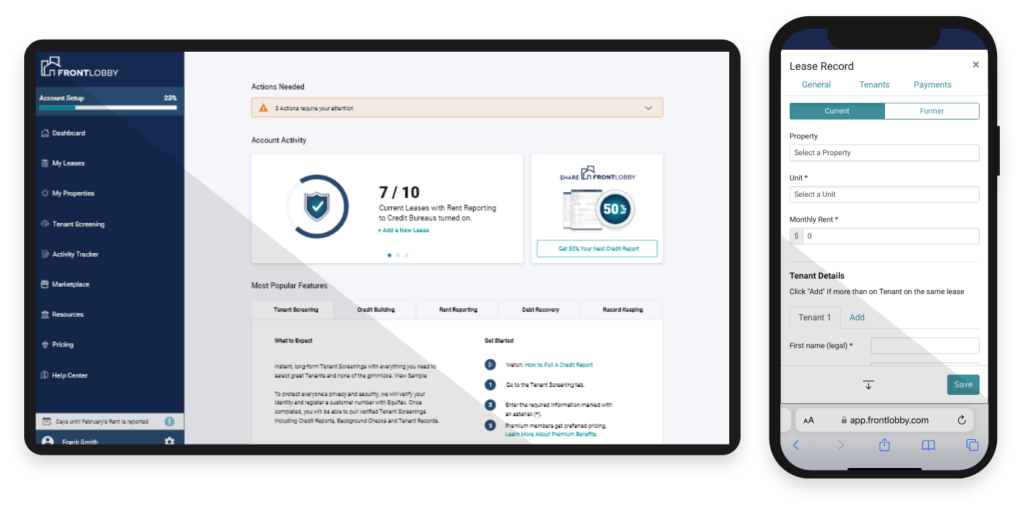

Rent Reporting services like FrontLobby provide a simple, straightforward way for both Tenants and Landlords to report rent payments.

As the U.S. rental market continues to evolve, Rent Reporting is gaining popularity. Renters appreciate the chance to build credit with payments they’re already making, while Landlords see the value in attracting reliable Tenants who are motivated to improve their credit scores.

Why Choose FrontLobby for Rent Reporting?

Renters using FrontLobby have reported credit scores jumps of 36 points to 84 points in the first 6 months. Overall, FrontLobby users report an average increase of 68 points.

Renters using FrontLobby can see their credit score increase in just a few months.

FrontLobby is among the pioneering providers of Rent Reporting in the U.S., assisting thousands of Renters in reporting their rent and building a credit history. Through a user-friendly online platform, monthly payments are seamlessly reported to Credit Bureaus like Equifax. Once an account is set up, the process is straightforward with no additional steps or paperwork required.

Rent payments appear on a Tenant’s credit report and can be used when calculating the Tenant’s credit score. Every payment made on time can contribute to building a positive credit history and will accumulate over time to result in a credit score boost.

FrontLobby provides Renters with a detailed overview of their payment history and alerts so that they can always stay up to date on payments, reducing the risk of late or missed payments.

Does FrontLobby Provide Other Services?

FrontLobby provides far more than Rent Reporting:

- Tenant Records: With FrontLobby, Renters can create a verified Tenant Record with the Landlord Credit Bureau. These records are vital for Tenant Screening, as Landlords and Housing Providers can review not just credit checks but also rental history, including whether a Tenant has adhered to lease terms, maintained the property, and paid rent on time. Having a verified Tenant Record can give Renters a competitive edge when applying for their next rental.

Additional Benefit: For Renters with limited or poor credit histories (such as those with invisible or thin credit files), a Tenant Record provides future Landlords with more comprehensive information beyond just the credit score, allowing them to make more informed decisions. - Comprehensive Tenant Screening: FrontLobby gives Landlords and Housing Providers one-stop access to credit reports from multiple Credit Bureaus, court records, public records, and Tenant Records—speeding up the screening process.

- Debt Recovery: FrontLobby allows Landlords and Housing Providers to report late and unpaid rent to licensed Credit Bureaus—minimizing losses due to delinquency and streamlining the recovery process.

Bonus: FrontLobby offers registered repayment plans to assist with settling debt. When both the Landlord and the Tenant agree to a repayment plan, the Tenant can continue to build credit while the Landlord reduces their Tenant debt.

With Rent Reporting delinquencies can decline by 92%.

FrontLobby was created to improve the rental experience for both Tenants and Landlords. The platform is reviewed and compliance-verified by provincial and federal regulators.

Did You Enjoy This Article?

Then You Will Love Our Newsletter